Editor's Note

No Huddle is proud to be an official partner of NOSOLO

NOSOLO is on a mission to improve mental heath awareness globally and remind people that they are never alone. NOSOLO donates 25% of all proceeds to the NOSOLO GIVE BACK FOUNDATION, a non-profit created to fund scholarships, school collaborations and community events. Nobody Goes Solo. NOSOLO.

5 referrals to No Huddle equals a free NOSOLO hat of your choice (referral buttons below).

Spread the word and get some free merch for doing it!

⚡ The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

Think about the last time you placed a little wager with a friend:

“How much you wanna bet I sink this putt?”

“$10 Judge strikes out here (in October)”

“Bet you can’t run a 6 minute mile”

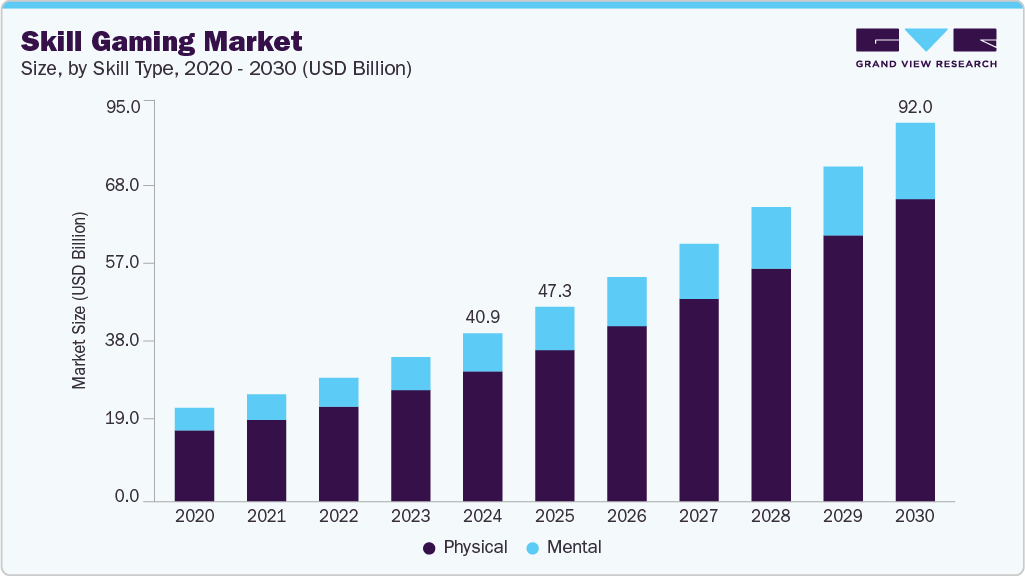

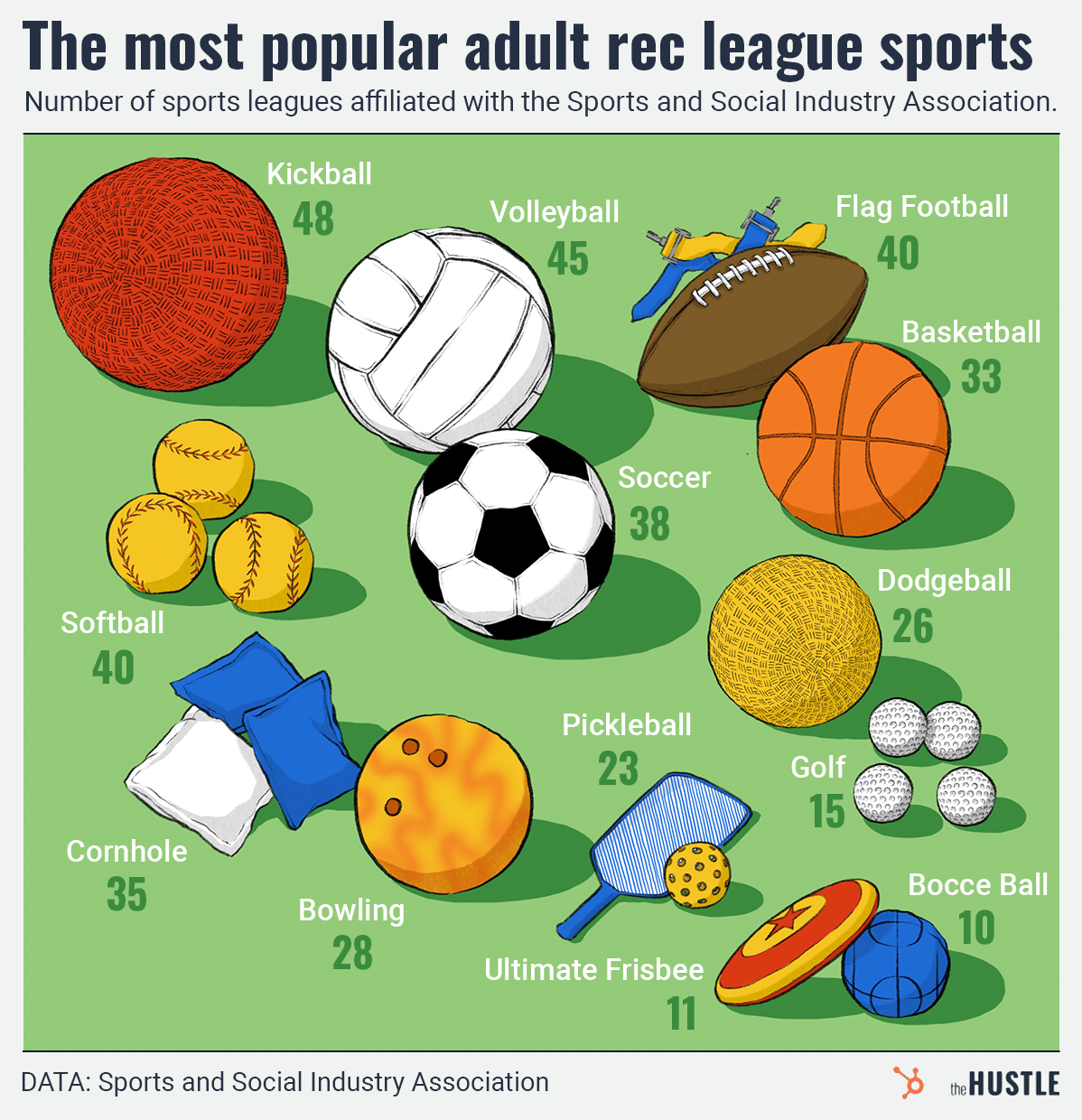

Peer-to-peer bets have always been normalized in our culture. No Huddle has covered the sports betting and prediction market boom in depth in previous editions, but what about competition for us regular folk? Today, skill-based gaming and social competition represent one of the fastest-growing slices of the broader gaming and entertainment economy, with global skill gaming alone projected to continue to grow at a double-digit annual clip.

From mobile apps that let you challenge friends in everything from poker to darts to weightlifting, to social platforms where you can spin up H2H contests in seconds, you can really put action on almost anything nowadays… queue the Adam Sandler in Uncut Gems “let’s bet on this sh*t” meme.

Why it Matters:

The thesis makes sense: humans have always been wired to compete, connect socially and experience the thrill of winning or the sting of losing. Neuroscience research shows that competitive and cooperative contexts activate brain networks involved in tracking social rank, competitive drive and predicting future outcomes in group settings. When we engage in competitive activities, our brains process complex social information more rapidly to keep up with opponents and teammates.

These cravings only intensified following the pandemic, when everybody was stuck indoors and subject to social distancing rules. The post-COVID surge of “sportertainment” aligns directly with this innate human drive to connect around games and shared stakes. No Huddle has spoken at length about the power of live events and has featured companies building in the space like VOW and On Location, but the in-person experiences don’t stop at big games, shows or work conferences.

According to Nextdoor research, 68% of US adults report meeting new people through sports, and 66% say sports make them feel more connected to their communities. The U.S. Census Bureau also found that over 22% of men and around 20% of women participate in sports, exercise, and recreational activities on any given day, and many adults use these sessions not just for fitness, but as a primary way to socialize and built community (Editor’s Note: my go-to Barry’s Bootcamp class in Tribeca is a testament to this).

Adult sports leagues have exploded in response to this demand. Volo Sports, now the largest adult social and rec sports organization in the US, started as a small bocce league in Baltimore in 2010 and has grown to more than 500,000 annual registrations across major markets nationwide. (Editor’s Note: You’re looking at a 2x NYC Men’s League Hoop Champ… player comp: Charles Barkley).

The Big Picture:

The convergence of sports, entertainment and hospitality has effectively created its own category: “sportertainment”. The sector blends competitive activities with premium experiences that include food, beverage, and other high-margin ways to draw a crowd. Research from Cushman & Wakefield shows that competitive socializing concepts have grown 386% since the beginning of 2021, underscoring just how quickly this category has scaled. Leading this charge are companies that fuse technology with sports and entertainment to create repeatable, data-rich experiences.

Look at Topgolf, which helped pioneer the modern category by turning driving ranges into a full family and/or corporate gaming experience for all skill levels. Dave & Buster’s remains a major player as well - not only serving elementary schoolers on field trips but also expanding internationally. The company reported $550mm+ in revenue in Q2 2025, and the market is watching upcoming earnings closely for signals about consumer spending habits.

Another emerging sportertainment HoldCo is Red Engine, the company behind Flight Club (social darts bars) and Electric Shuffle (tech-enabled shuffleboard). Red Engine directly owns and operates a number of venues in the UK and US, while also allowing licensed partners to help expansion to new US cities and global markets.

The sportertainment model as a whole works well because it combines multiple needs into one premium outing. Groups can combine fun with competition, quality food and drinks and social time with friends, all while feeling like they are a getting a VIP experience (without needing a suite or club seat).

Zoom In:

The explosion of skill-based gaming and social competition isn’t just about physical venues – mobile technology has democratized and reshaped the competitive gaming landscape. As 5G networks roll out globally and high speed wi-fi becomes standard (Editor’s Note: except on my last Delta flight), smooth real-time multiplayer connections are easier and more reliable than ever. Layer in the rise in peer-to-peer betting platforms, plus streaming and AI-driven matchmaking for fair competition, and you get an ecosystem designed to keep consumers coming back

On the company specific side, we are seeing an interesting divergence in outcomes: As mentioned earlier, Volo Sports has seen its revenue increase roughly 5x since 2019 and, after a $21mm investment from Bluestone Equity Partners in 2024, acquired rival ZogSports earlier this year to create the largest social platform in the US.

Topgolf, by contrast, sold to Callaway in a roughly $2bn all-stock merger back in 2020, but the combined businesses struggled to deliver the growth and synergies investors expected. Last month, Callaway agreed to sell a 60% stake in Topgolf (and some related tech assets) to Leonard Green & Partners at a ~$1.1bn valuation, locking in a meaningful valuation reset for one of sportertainment’s flagship early success stories.

By the Numbers:

The Bottom Line: We’re seeing it everywhere we look, and the numbers don’t lie. Adult sports participation, online gaming continues to scale into a $100bn+ market, and sportertainment venues keep opening in cities around the world. One way or another, some form of social competition is likely to trickle into your day-to-day life — through a rec league, group chats or the apps you typically use.

No Huddle is a buyer of the social competition arena, and of most things that draw humans together: a game, a wager or a shared experience. As technology continues to develop and strip friction out of how we find opponents, track results, settle stakes and even find things to do, the next wave of formats and offshoots are only just getting started.

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

The Company: Lucra

The Business in a tweet: Competition is Lucra’s DNA. Lucra builds technology for entertainment, hospitality, and media brands that allows clients to host tournaments and customers to create personalized challenges. Integrated directly into a brands’ sites and apps, Lucra turns everyday experiences into long-lasting loyalty. Lucra’s value proposition is a flywheel: driving visitation, increasing engagement, and adding more revenue per visit.

The 101:

Industry: Loyalty Software

Headquarters: New York, NY

Year Founded: 2019

Founding Team/Current Leadership:

Dylan Robbins - Founder & CEO

Michael Madding - Chief Operating Officer

Ed Psyk - Chief Risk & Compliance Officer

Mike Schmidt - Chief Technology Officer

Chris Stango - Chief Experience Officer

Employees: 22 FTEs

Fundraising Status:

Raised $10M Series A in December 2024

Notable Investors: 7GC, SeventySix Capital, Steve Kuhn (founder of Major League Pickleball, Giannis Antetokounmpo, Ark Invest, Raptor Group, Visible Ventures

Business Model:

SaaS:

Monthly/Annual subscriptions, tiered based on venue count, transaction volume and customization

Usage fees based on Scale: commission on real-money wagers (typically 2-5%)

Revenue share between venue and brand on Lucra-hosted competitions

Early Traction:

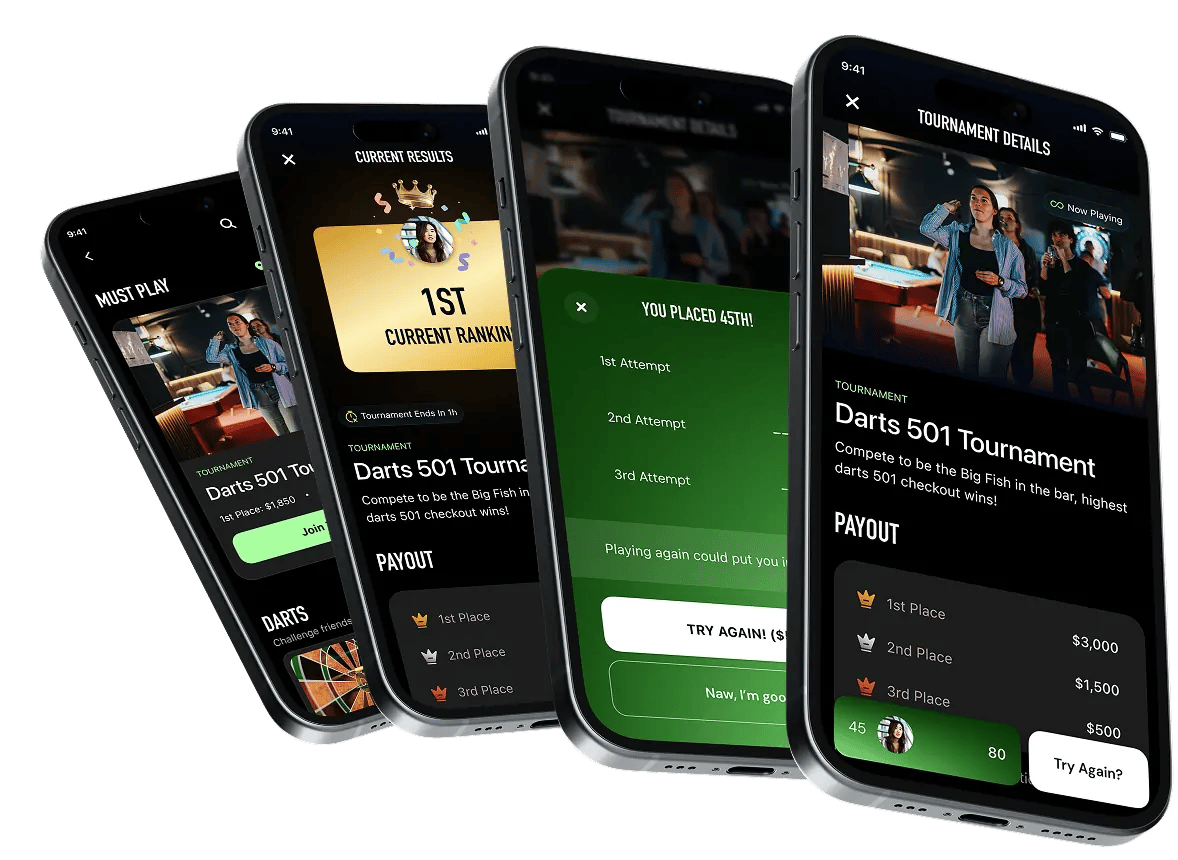

Over the past 12 months, Lucra has signed nearly 30 partnerships across entertainment, media, hospitality, fitness, and digital gaming. Highlights include Dave & Buster’s (223 locations), Five Iron Golf (leader in indoor golf and entertainment), Puttshack (tech-infused mini golf leader), and TouchTunes (bars nationwide). Recent partnerships with HiQOR (biometric fitness platform), GotGame (TikTok-style gaming), and Playground Productions (Backyard Sports franchise) further validate Lucra’s ability to scale across industries and demonstrate strong market demand.

Deep Dive:

Pros:

Category Creator Advantage: Lucra sits at the intersection of SaaS, loyalty, social gaming, and fintech — tapping into a TAM in the hundreds of billions, not millions

No other company sits at the nexus of loyalty, gaming, and fintech

Proven Commercial Validation: Active partnerships with blue-chip brands across sports, hospitality, and entertainment (e.g., Dave & Buster’s, Puttshack, Five Iron Golf, TouchTunes) demonstrate demand and adoption across multiple verticals.

Regulatory & Compliance Moat: Unlike startups dabbling in gamification, Lucra owns the risk, compliance, and payments layer, creating a defensible moat and lowering barriers for partners to rollout

Built in wallet & fund management for payments

Handle all compliance surrounding KYC/AML end-to-end

Technology Edge: SDK is modular, mobile-native, and white-label — partners can launch quickly, customize branding, and seamlessly integrate into digital + in-venue experiences.

Market Tailwinds: As outlined in No Huddle Vol: 11, prediction markets, gamification and loyalty is the name of the game right now. As more and more states and companies become open to these “new-er” methods of consumer engagement, Lucra can be at the forefront of entertainment loyalty

Cons:

Education Curve: Many enterprise partners still view competition as core to drive loyalty, requiring Lucra to educate markets on the distinction of skill-based social gaming and how to successfully adopt a novel business unit to their model.

Integration Dependence: Speed of adoption is tied to partner tech cycles and priorities — SDK requires partner development bandwidth to fully embed.

Regulatory uncertainty: As with anything in the wagering world, there is always risk that legislation derails innovation

Comparables:

📶The Signal (No Huddle’s Take): We see the vision. Lucra has built an compelling product that truly sits at the intersection of SaaS, loyalty, social gaming and fintech. The early strategic partnerships Lucra has signed with sportertainment and hospitality brands entrench it at the center of the growing ecosystem. Clients like Five Iron Golf are already using Lucra to power on-venue competitions, daily prizes and leaderboards — often in ways that feel so smooth and native that consumers don’t even realize there is a third party engine underneath!

On the growth side, the key questions now are where Lucra partners next and what the unit economics will look like — customer acquisition costs, conversion to active players and retention rate once they have tried a Lucra-powered experience. Lucra has a top-notch executive team and a cap table that includes some of the most well respected investors in the sports and entertainment world that can help catalyze this next phase of growth.

No Huddle is especially bullish on Lucra because of the regulatory and operational infrastructure it has already built: Lucra spent time investing and developing the legal framework around payments, compliance and risk management for peer-to-peer contests across dozens and dozens of US states, and today it already acts as an all-in-one layer for partners. We’re taking the bet - and expect to see others on the leaderboard with us.

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.