Editor's Note

No Huddle is proud to be an official partner of NOSOLO

NOSOLO is on a mission to improve mental heath awareness globally and remind people that they are never alone. NOSOLO donates 25% of all proceeds to the NOSOLO GIVE BACK FOUNDATION, a non-profit created to fund scholarships, school collaborations and community events. Nobody Goes Solo. NOSOLO.

5 referrals to No Huddle equals a free NOSOLO hat of your choice (referral buttons below).

Spread the word and get some gear for doing it!

⚡ The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

Everybody has their own COVID story - a personal account of how life changed when the world came to a grinding halt, and what they missed most about “normal life”. For many, months of isolation, social distancing and “bubbles” sparked a deep yearning for live events shared experiences once again.

While live events suffered a major blow during the pandemic, they have since rebounded in full force. This resurgence highlights a fundamental truth: people have an innate desire to come together over shared passions. But what exactly defines the universe of live events? And where is the industry headed? Let’s dive in.

Why it Matters:

Calling post-COVID demand for live events “pent-up” would be an understatement. In 2024, Live Nation - the world’s largest concert promoter - reported a record $23bn in revenue, with over 50 million fans attending 50,000+events.

Live sports are riding their own wave of steady growth. According to Two Circles, US sporting events drew 292 million attendees in 2024 - a 3% increase YoY. Notably, Women’s sports accounted for half of this jump, underscoring a shift in fan dynamics and broader engagement. We have seen surges in popularity, investment, and media rights deals for the WNBA, NWSL and even new leagues like League One Volleyball.

As demand increases, so have the barriers to entry. 19 of 20 Premier League clubs raised ticket prices for the 2024/25 season, while fans across the globe are continuously being priced out of attending marquee events. Here’s an example of the rising costs for families to attend an NFL game (on average):

Source: GiveMeSport

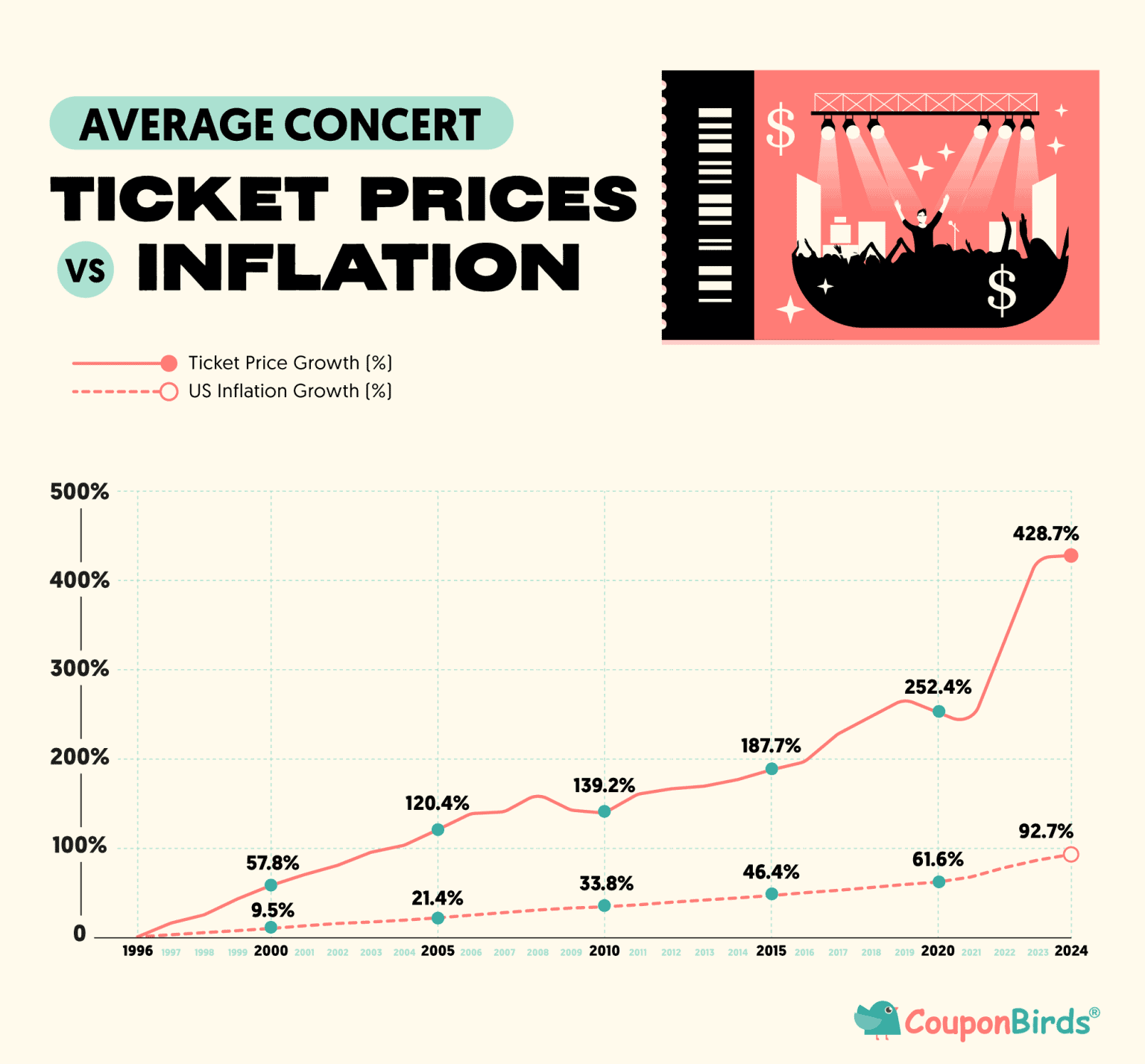

Concerts are seeing a similar rise in hype and prices. Look no further than Taylor Swift’s legendary Eras Tour, which grossed over $1bn in 2024 and saw ticket prices reach astronomical levels.

Source: HypeBot

The Big Picture:

The live event economy is an intricate, interconnected ecosystem that spans multiple industries. Let’s try to map it out and break down some of the key stakeholders:

Sports Leagues and Teams: Professional and college sports generate billions from live events. While skyrocketing media rights have driven the recent valuation boom, stadium-generated revenue - especially from the surge in mixed-use developments - is a rapidly expanding vertical

Concert Promoters/Live Music: conglomerates like Live Nation dominate the entertainment landscape. Ticketmaster (which merged with Live Nation in 2009) now controls ~80% of primary ticketing for major concert venues and most NBA, NFL and NHL stadiums

Media Companies, Streaming Services, Rights holders: Legacy Media giants are battling with insurgent Tech companies for the ever-growing live sports and entertainment right-share pie. As explored in No Huddle Vol 1, this landscape is constantly evolving, with headlines often driven by consolidation opportunities and tech influence (we are looking at you, $WBD ( ▼ 2.19% ) and $PSKY ( ▲ 20.84% ) ). Content remains king, and live sports continue to anchor viewership in an ever-crowded field:

Source: @novy_williams

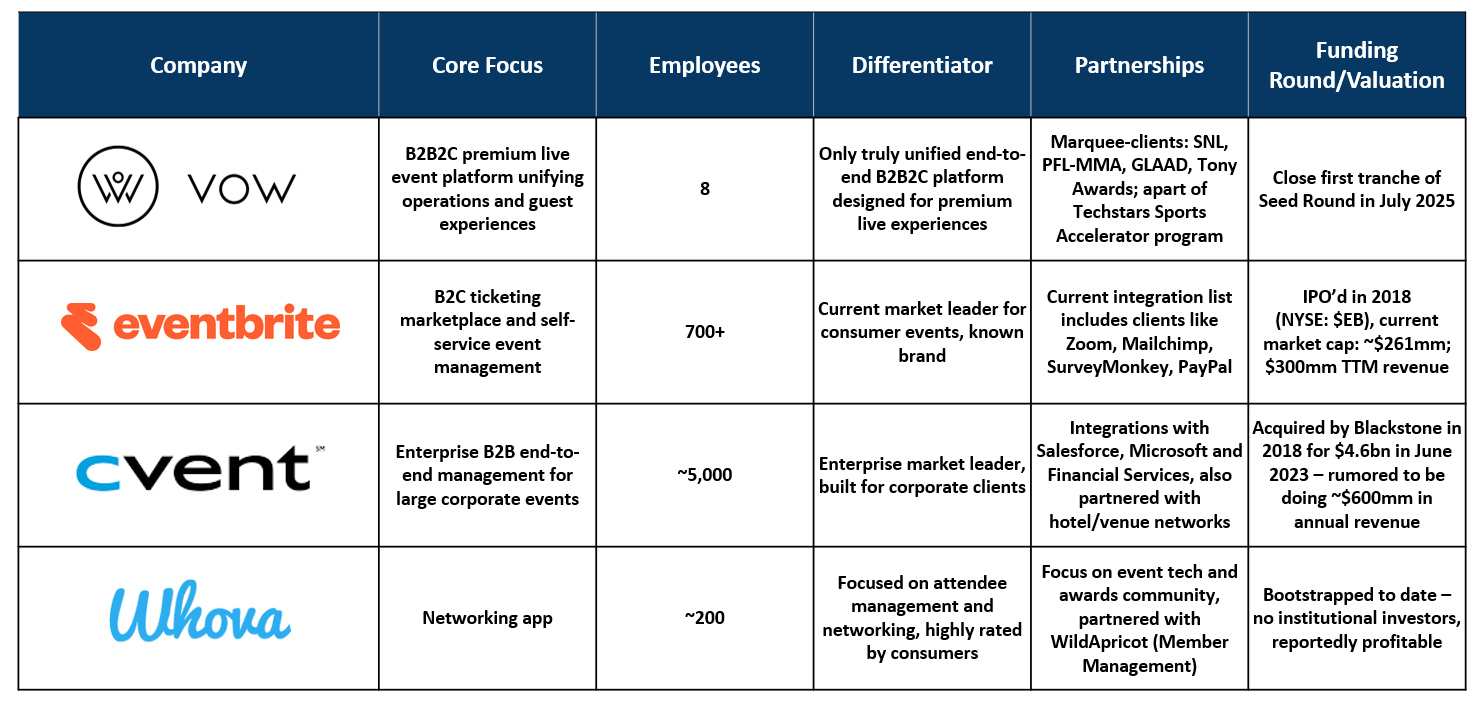

Technology and ticketing platforms: This is where No Huddle sees the greatest upside in the early-stage startup world. Live events are woven into the fabric of society, yet their underlying technology remains fragmented and outdated. There is substantial room for improvement - both in enhancing the fan experience and in streamlining event operations. No Huddle featured Jump in Volume 9, and we have several other promising companies in the pipeline. These startups are trying to unify ticketing, data and fan engagement all into one… in turn generating a smoother and more accessible experience for everybody.

Zoom In:

Nothing illustrates live event dysfunction quite like the Ticketmaster x TSwift debacle of 2022. When Eras Tour tickets went on sale, the website buckled under unprecedented demand. Bots (which Ticketmaster had tried to block) snatched up a large stash of the coveted tickets, only to resell them at staggering markups. The fallout was swift: more than two dozen fans filed class-action lawsuits, and the saga quickly dominated social media, water cooler conversations and carpool pickup lines. We’re still in regulatory limbo with a major antitrust case from the DOJ, the FTC and multiple states suing Live Nation / Ticketmaster.

Hidden fees are another common complaint. We’ve all felt the annoyance and sting of unexpected surcharges for tickets at checkout. Startups like TickPick and Gametime emerged to tackle this problem, building their brands off transparency and no-fee ticketing. Both now reportedly boast over a billion dollars in lifetime sales.

No matter how the lawsuits shake out, one thing is clear: the ticketing system for live entertainment is fundamentally broken and overdue for disruption… as much as the scalpers yelling “Need Tickets? Buying Selling tickets?” is a core memory of any live event experience.

By the Numbers:

As the live event market soars, legacy media companies that broadcast and stream these experiences are in full transformation mode. Cord cutting has paralyzed these media businesses, who once thrived off customers bundling sports, shows, and awards into a single package no matter the channel.

Recent deals highlight the rapid pace of change. After Skydance, led by David Ellison, finalized its merger with Paramount, speculation has turned to Warner Bros. Discovery, which is now now actively exploring a sale or other alternatives to “maximize shareholder value”. The industry rumor mill is in overdrive as legacy players reposition for a future dominated by streaming, DTC and disruptive tech.

WBD: +116% YTD: driven by M&A tailwinds, not company performance

Netflix: +28% YTD

Paramount: +5.5% YTD: Skydance merger

Paramount Skydance Corp is up 60% YTD

Comcast: −27% YTD

The box office side is experiencing a similarly turbulent future as the influence of big tech grows. Since 2019, domestic box office revenue has steadily declined, saddling theater chains with significant financial woes. AMC narrowly avoided bankruptcy by restructuring its debt stack, while Regal’s parent company, (Cineworld), emerged from bankruptcy with a capital raise.

Meanwhile, concerts - led by the aforementioned Eras tour - are seeing a resurgence. Pollstar‘s 2024 year-end report, pegged the ticket price for a top concert tour at $135. By comparison, the average ticket for The Eras Tour was $499. But the spending doesn’t stop there: concertgoers pushed merchandise sales up 5% YoY, even as spending on food and drinks dipped slightly (3%).

Source: AtVenu: The 2025 Fan Spending Report: What Concertgoers Are Buying Most

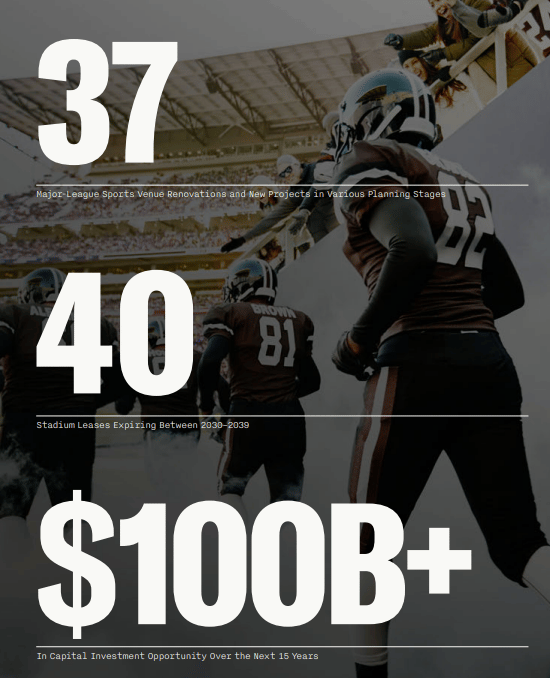

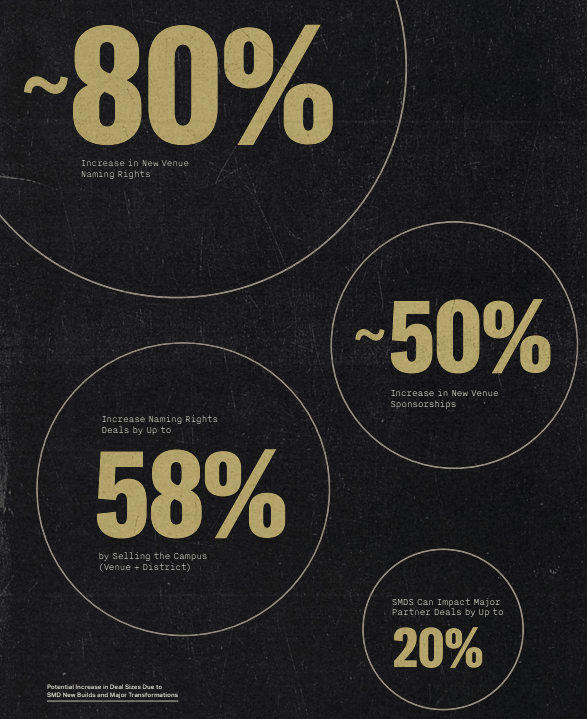

On the flip side, the live entertainment industry is seeing major growth in mixed-use developments. A recent whitepaper from Klutch Sports and RBC spotlights this this market, highlighting how these new districts are redefining the value of sports venues beyond gameday.

These developments deliver value far beyond gamedays - they play a major role in boosting the entire sports, media and entertainment industry. Look at the jump in naming rights, sponsorship value and partnership opportunities for mixed-use developments.

The Bottom Line:

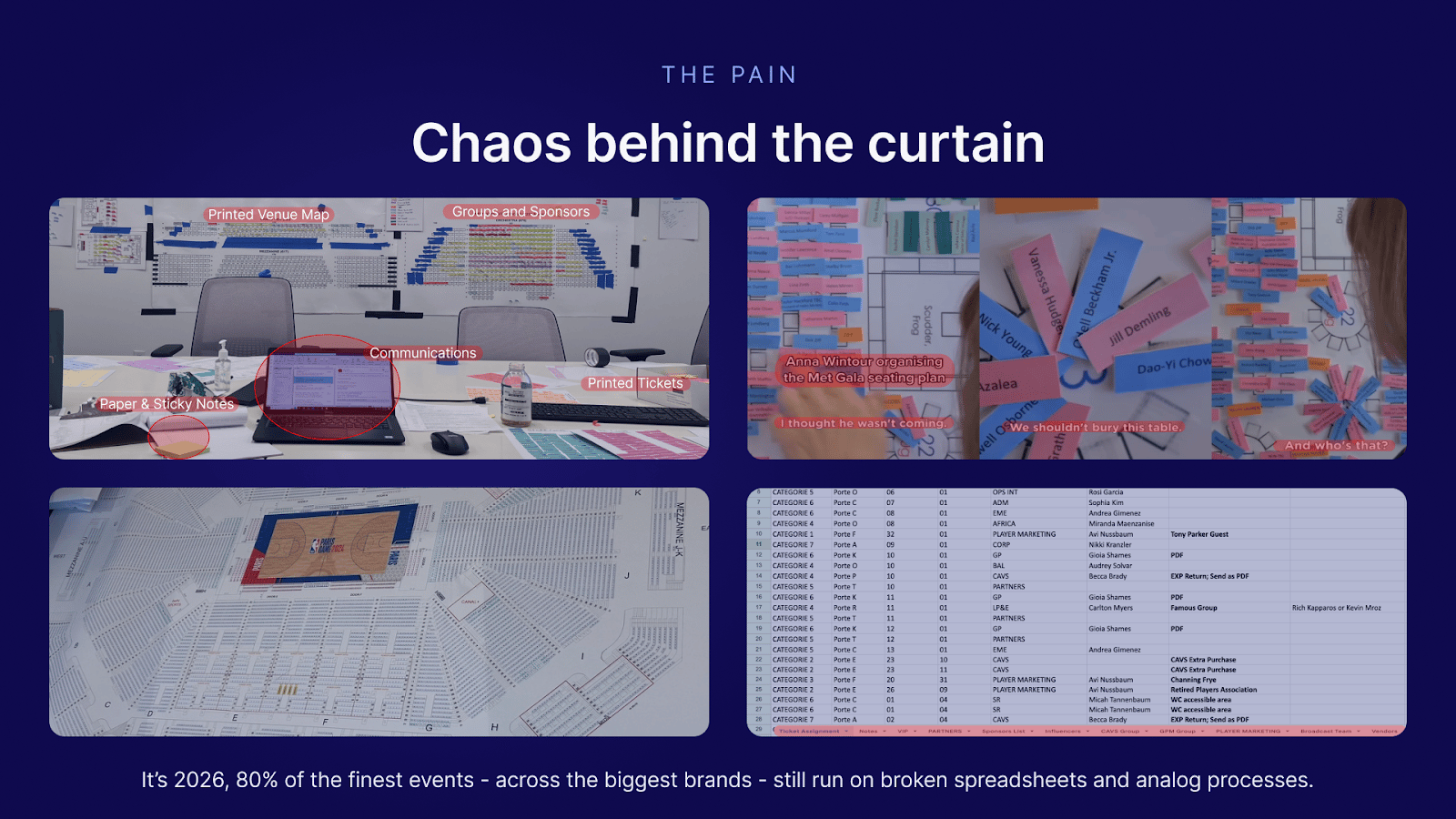

The live events industry stands at a fascinating crossroads. Interest, attendance and spending have surged to new heights as consumers flock to sporting events and concerts. Demand for shared experiences - especially those with viral, over-the-top aspects has never been stronger. Yet, for all this momentum, the industry continues to lag in innovation. Much of the technological infrastructure - ticketing, technology, operations, event planning, guest management and more - are still stuck in the past and need a major upgrade.

No Huddle projects that many of the stars of tomorrow will emerge from this live events craze. The winners will be those who are obsessed with improving and streamlining both the fan and company/team experience, bringing fresh ideas and modern tech to one of the world’s oldest (and most critical) industries.

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

The Company: VOW

The Business in a tweet: VOW is the first AI-powered B2B2C operating system for the $2T Live Experience Economy — giving live events a brain, professionals superpowers, and guests, attendees, and fans hyper-personalized experiences at scale. The platform unifies event planning, operations, seating, ticketing, communications, and guest intelligence into one connected ecosystem.

The 101:

Industry: Live Experience Infrastructure / Event Management Software / Sports & Entertainment Technology

Headquarters: New York, NY

Year Founded: 2023

Founding Team/Current Leadership:

Jennifer Brisman: Founder & CEO, 20-year industry veteran

Employees: 8

Fundraising Status:

Closed first tranche of Seed Round in July 2025. Led by KB Partners with participation from Capitalize VC, Alumni Ventures Sports Fund, Better Angels Ventures and Jim Kaplan (Chasella Capital / Two Kap Ventures)

Notable pre-seed investors include Techstars Sports, Chloe Capital, Everywhere Ventures / The Fund XX, and Blue Falcon Capital.

VOW has now raised a total of $3.25mm at a $6mm pre / $8.5mm post-money valuation.

Business Model:

Enterprise SaaS with modular B2B and B2C layers

VOW PRO – A B2B suite for event organizers and operators, replacing 8–10 disconnected tools with one unified platform that centralizes workflows, data, and communications across stakeholders.

VOW GO – A white-labeled mobile companion for guests, attendees, and VIPs — acting as a real-time concierge for arrivals, check-ins, ticketing, and live updates.

VOW Groups & Sponsors – Dedicated group-management and partner modules for corporate and VIP clients, offering branded experiences, dynamic seating, and priority access.

Revenue comes from annual enterprise contracts and tiered SaaS subscriptions with optional add-ons for ticketing, seating, and communications.

Value Prop: VOW bridges the disconnect between event pros, stakeholders, and guests through real-time data and AI intelligence. It automates manual tasks, eliminates friction between collaborators, and unlocks personalization at scale — turning what was once operational chaos into orchestrated intelligence.

Traction:

VOW is already proving category leadership from the top down:

Trusted by NBC’s Saturday Night Live, The Tony Awards, PFL-MMA, GLAAD Media, and NYU.

Active discussions with HBO / Warner Bros., Netflix, Triton Poker, and World Poker Tour

Exceptional retention: nearly every customer renewed for Year 2, several for Year 3.

Deep Dive:

Pros:

Category Creation in a $2T Market: Every major industry already has its OS — Salesforce, Shopify, Toast, Procore. Live experiences don’t. VOW is building it, unifying one of the world’s most fragmented ecosystems

AI Where It Actually Matters: Live events are high-stakes, one-of-a-kind, and built on proprietary workflows. VOW’s AI learns from each organization’s internal data to automate, predict, and personalize…without relying on public models or risking data trust

Proven Top-Down Adoption: Early wins with blue-chip clients validate the model and open expansion into adjacent verticals from sports & entertainment to hospitality and corporate

Founder-Market Fit: CEO Jennifer Brisman spent two decades living this fragmentation firsthand, bringing industry credibility and an insiders perspective to building the solution

Cons:

Highly Fragmented Ecosystem: The opportunity is massive, but no one has ever gotten it right. A web of disconnected people, platforms, and processes means scale depends on precision and trust

Breadth vs. Depth: With so many adjacent use cases (sports, corporate, entertainment and more), prioritization is key to maintaining product clarity and profitability

Low Margin for Error: In live events, execution is everything — even minor glitches can carry outsized reputational risk

Comparables:

VOW head2head vs:

Eventbrite is mass-market focused while VOW specializes on premium events

Cvent lacks guest-facing intelligence and AI-driven personalization - VOW unifies both sides of the event

Whova is very limited on attendee engagement while VOW is the operating system for all stakeholders

📶The Signal (No Huddle’s Take):

This is exactly what the live events industry needs - a true one-stop shop that works seamlessly for both clients and consumers. VOW is the operating system that sits above the fragmented ticketing world, connecting guests, organizers, sponsors and data in one place and in real-time. We see VOW as much more than a simple digitization of event management; its the next-gen motherboard powering every facet of live experiences.

Having been both an attendee and involved in planning events from VIP sports experiences to charity galas to industry conferences, I can attest: the need for unified, intuitive tools has never been greater.

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.