⚡ The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

Back in 2007, Robert Kraft and the New England Patriots unveiled Patriot Place – a mixed-use development built around Gillette Stadium, the home of the Patriots. For $350 million, Kraft created the first of its kind all-in-one complex with retail, dining, entertainment and hospitality venues within walking distance from the stadium. This project quickly became a harbinger for the future of the sports world.

Why it Matters:

As new investors enter the space and sports team valuations continue to balloon, all eyes are on franchise growth. While leagues have historically relied on media rights to generate large chunks of revenue (and will continue to do so), teams are now seeking alternative ways to diversify income and cover the rising costs of operations (Deloitte Economic Impact of Sports). Besides seeing success on the field/court, owning your team's stadium is another major lever. No matter how bad your team is (Editor’s Note: looking at you Jets fans), stadiums can still be rented out for events like Taylor Swift concerts, which can generate revenue from rental fees, concessions, parking and cuts of merchandise and sponsorships. Or, you can host the Savannah Bananas and sell out your stadium for a weekend.

When Mark Cuban sold the Dallas Mavericks to the Adelson family in 2023 for $3.5 billion, he highlighted the direction teams may be headed today: aligning their developments with sports betting and casino integration. While the Mavericks have experienced their fair share of ups and downs in the years since on the court, sports betting remains illegal in Texas, and is not expected to be voted on again until 2027.

At No Huddle, one of our core beliefs – and where we see the sporting world headed – is shaping experiences around the fan. For teams, keeping their fans engaged at the stadium year-round helps boost their lifetime value (LTV), increase brand awareness and of course, help push alternative revenue streams.

The Big Picture:

This trend isn’t in its early days – it's already upon us. A Deloitte report from November 2024 projected that over 300 global sports stadiums were expected to be upgraded (either renovations or new build) in 2025. The current state of American professional sports stadiums is littered with renderings and plans for new stadiums and mixed-use complexes (the Spurs also just received approval for a new arena downtown in 2032):

Once these developments are financed, built, and operational, the focus shifts to premium, personalized hospitality. Today’s consumers crave experiences they can share on social media, impress friends or clients and find reasons to come back for more. Regardless of seat or package, we see these enhancements all-over. The Barclays Center has a slew of exclusive perks for American Express cardholders, Wrigley Field has a DraftKings Sportsbook attached to it, and the Intuit Dome has upgraded, roomier seats and nearly four times as many bathrooms as the average NBA arena.

Many of these upgrades also include amenities like contactless ticketing and ordering, enhanced wi-fi and mobile apps to bring the stadium experience to the fans phone.

Zoom In:

Since Patriot Place opened in 2007, several other notable multi-purpose complexes have followed suit. The Battery Atlanta is the latest standout, situated across 75 acres surrounding the Braves Truist Park. The Battery offers a wide array of dining and shopping options (including a Braves specific clubhouse store), a concert venue, hotel, parks, apartment complexes and convenient public transportation.

Is that enough? Well, the impact is clear and visible with the Braves being the sole publicly traded team (Editors Note: The Blue Jays are owned by Rogers Communications, which also owns stakes in a number of professional teams). In August, Atlanta Braves Holdings (Nasdaq: BATRA, BATRK) reported Q2 Earnings showing that even with the Braves underperforming mightily this year, 1H 2025 revenues were still up $40mm YoY across the same number of home games. A reason why? Mixed-use revenue rose +37% YoY (~$12mm of growth). In 2023, over 9 million people visited the Battery, and 21% of visitors were from out of state.

Stadium finance also hints at what is to come. Whether that be the Chicago Bears possibly moving outside of downtown Chicago to Arlington Heights or the recently greenlit full scale resort complex in Las Vegas that includes an NBA-ready arena — sparking speculation about league expansion.

By the Numbers:

Financing these mixed-use developments remains a significant challenge, with team owners, local politicians, and taxpayers often at odds over how much support the public should be providing for billionaire owners and organizations. However, teams pitch these projects as “win-win scenarios”, promising benefits for both the team and the community:

While most “win-win” scenarios can seem too good to be true, there is reason to believe that mixed use developments may be different. A recent IBM survey showed that 35% of fans plan to watch more live content over the next two years, and 29% expect to attend more events in person. PwC analyzed the evolution of sports fans and how premium offerings elevate their overall experience:

Hospitality now also involves an individual vs corporate dynamic. In fact, 90% of fans aged 25-44 believe premium offerings are critical when attending with clients compared to 70% of 55 and older fans. Younger fans expect more, and teams must deliver memorable experiences to keep them coming back – whether that's for business or personal reasons.

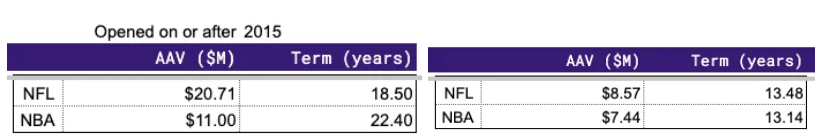

Another incentive for team owners to invest in a new stadium and adjacent complex is naming rights. Recent deals for stadium naming rights command a significant premium to older venues, whose naming rights have been locked up for years.

Source: SportsProMedia

Notably, four of the five highest-value annual naming rights deals were struck for stadiums built after 2020, a trend expected to continue as the competitive landscape and marketing dollars rise (we’re looking at you AI companies on your Series D raise)... Anthropic Arena here we come!

The Bottom Line:

Whether its expansion, new stadiums or bolt-on amenities, expect this trend to persist as sports teams work to grow their footprint and valuations. No Huddle is particularly interested in how this will play out among premier college programs. While many universities are developing student-focused housing and retail around their stadiums, we can’t be far out from hotels, complexes and premium offerings for alumni and fans. At the professional level, the surge in new stadium complexes – and ongoing wrangling between teams and taxpayers over financing is certainly set to continue. Ultimately, teams are more focused than ever on additional revenue streams, and mixed-use complexes have proven to be a lucrative form so far.

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

The Company: On Location Experiences

The Business in a tweet: On Location connects fans to premium experiences by providing luxury hospitality, end-to-end management and tailored offerings. Now a subsidiary of TKO, On is an official partner of over 150 major organizations in the sports and entertainment world.

The 101:

Industry: Sports and Entertainment Hospitality

Headquarters: New York, NY

Year Founded: 2010 - started as NFL On Location in 2004 (see timeline below)

Founding Team/Current Leadership:

Paul Caine – President of On Location and IMG Events

Ed Horne – Chief Operating Officer

David Geithner – Chief Financial Officer

Jennifer Ogden – Chief Marketing Officer

Employees: 500+

Fundraising Status:

Business Model:

Core Revenue Streams:

Hospitality Packages

Corporate Entertainment: Bespoke offerings

Travel Services: Offer end-to-end travel packages

Event Production: Assist with live production and logistics

Traction:

Estimates show growth from ~$35mm in annual revenue in 2015 to $800mm in annual revenue under the TKO Group umbrella (Editor’s Note: Endeavor was taken private by Silver Lake in March 2025, and On Location slid into the still public $TKO ( ▲ 0.03% ) portfolio)

Largest hospitality program in Olympic history (Paris 2024), with 2026 FIFA World Cup projected to exceed it

Deep Dive:

Pros:

Premium Partnership Moat: Entrenched market leader in premium offerings with long-term partnerships for premier events

Global Expansion

Positive Unit Economics: High margins, traditionally low churn, large parent backing (through TKO and Silver Lake)

Proven Business Model and Scalability

Industry tailwinds: Sports in the midst of an industry-wide boom, and premium services will continue to see demand

TKO Synergies: Easier promotion and execution for go-to events under TKO umbrella:

Cons:

Live event concentration risk: vulnerable to economic sensitivity should consumer sentiment / wallets downshift

Upfront costs - business model reliant on partnerships and ability to sell premium events

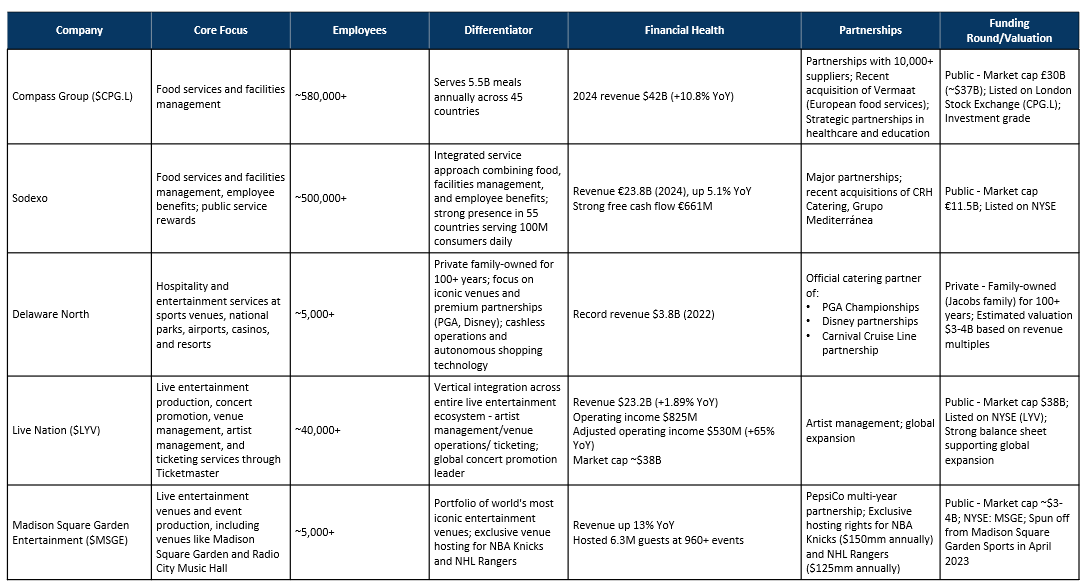

Comparables:

📶The Signal (No Huddle’s Take): On Location is already a household name in the sports and entertainment world. As fans continue to flock to live events, and teams push for bespoke and marquee offerings, On is well-positioned to reap the rewards. We expect On Location to leverage its footprint to expand further into adjacent industries such as travel, and possibly even NIL. The experience of top recruits or players family’s visiting campus may soon be completely transformed. To maintain its advantage, On must remain fan-first and let consumers wants and needs guide its offerings and future direction.

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.