Editor's Note

NOSOLO is on a mission to improve mental heath awareness globally and remind people that they are never alone. NOSOLO donates 25% of all proceeds to the NOSOLO GIVE BACK FOUNDATION, a non-profit created to fund scholarships, school collaborations and community events. Nobody Goes Solo. NOSOLO.

Starting today, 5 referrals to No Huddle equals a free NOSOLO hat of your choice (referral buttons below).

Spread the word and get some great gear for doing it!

Let's dive into this week’s edition…

⚡ The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

Sports, betting, crypto, retail trading: Four pillars of society nowadays that all exploded to new heights in a post-COVID world. It makes logical sense that the next “big thing” would be to combine them all… and that’s how prediction markets were born. Prediction markets have ignited both the gambling and fintech industries, creating a brand new world that skates around many regulations while exploding in popularity.

As featured in No Huddle: Volume 4, the sports betting world remains fiercely competitive but traditionally dominated by major players like FanDuel and DraftKings. However, this landscape is shifting, as prediction market startups like Kalshi and Polymarket have taken the world by storm. These platforms exploded during the 2024 Presidential election, where prediction markets were much quicker to forecast the landslide Trump victory than polling data.

Polymarket 10/26/2025

Why it Matters:

Prediction markets are the natural derivative of the sports betting boom. Consumers nowadays crave gamification, quick outcomes and a broad range of options. While traditional sportsbooks position themselves as entertainment venues where customers bet against the “house” at fixed odds, prediction markets have flipped the paradigm by offering binary contracts on a peer-to-peer exchange — much like how Wall Street operates.

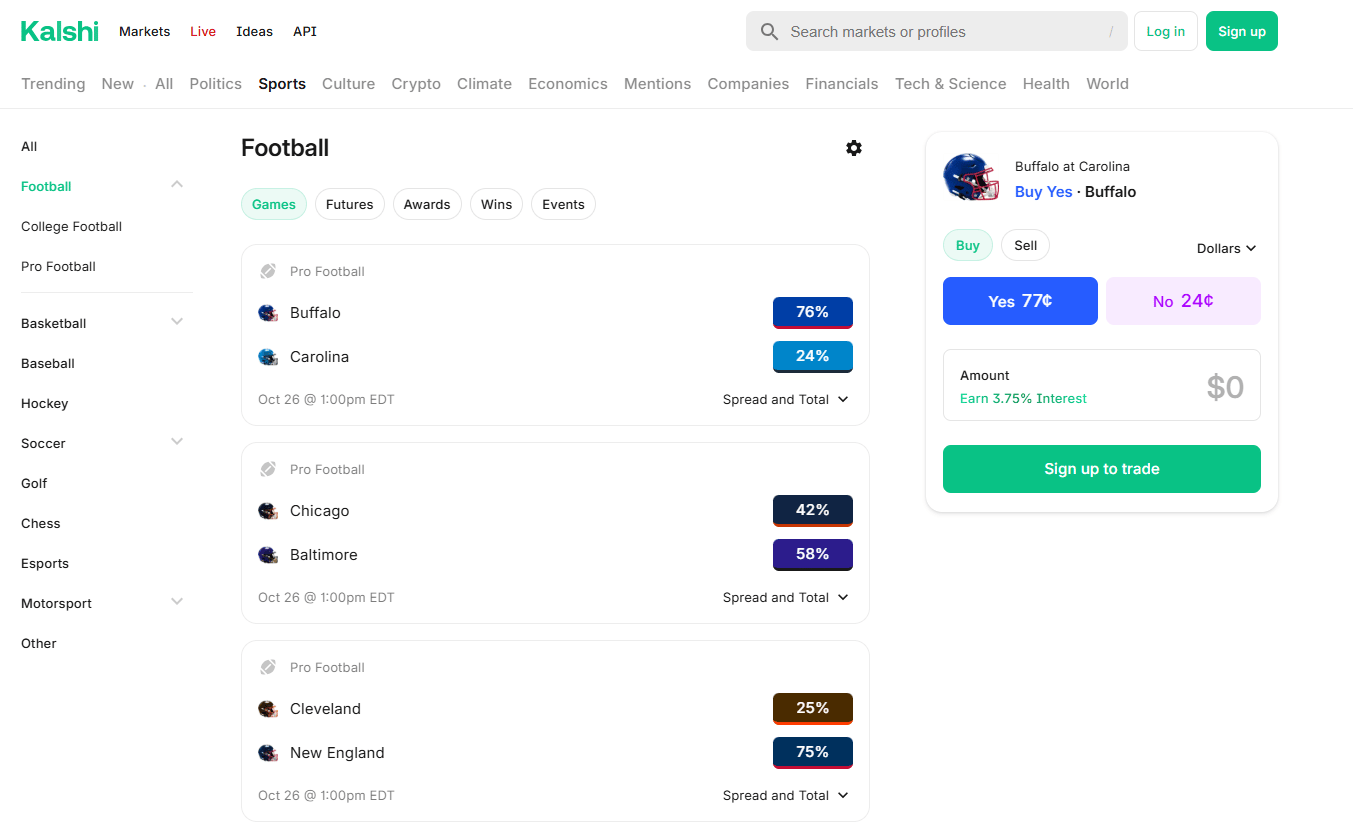

The regulatory piece is a large one too. Many states have scratched and clawed to legalize betting (now up to 38 states plus Washington, DC) and have patched together various regulations, prediction markets are technically considered financial exchanges. This means they are regulated by the Commodity Futures Trading Commission (CFTC) (Morning Brew). Because of that nuance – or arbitrage – prediction markets can be offered across the US, even for events tied to sports. Traditionally, platforms like Polymarket and Kalshi haven’t had licenses with professional leagues, meaning they aren’t permitted to use official team names, logos, trademarks or likenesses. Instead, they opt for generic city names or references to teams:

Kalshi 10/26/2025

This caveat is critical, as leagues like the NFL have mega-partnership agreements with sportsbooks to serve as “official partners” of the league. For example, the NFL has three official partners: DraftKings, FanDuel and Caesars. The deals collectively are estimated to be worth nearly a billion dollars… certainly a nice paycheck for the NFL.

Just yesterday, the NHL chartered new territory — entering into a partnership with Kalshi and Polymarket, the first such deal between a major professional league and prediction markets. The NHL, which already has licensing agreements with 10 sportsbooks in the US and Canada, is now expanding its footprint and fan engagement across all available mediums. Keith Wachtel, president of NHL business said "The handle in sports is growing for the sportsbooks… We believe the rising tide is lifting all boats here."

Kalsi CEO Tarek Mansour called the NHL agreement a “seminal moment for prediction markets”, staking a claim that it’s only the beginning of of something bigger. Could we see other leagues follow suit? History — and the league's pursuit of new revenue streams through partnerships, as well as viewership (which betting is proven to help boost), would suggest yes.

The Big Picture:

The modern era of prediction markets began in 2020, when Polymarket launched as a blockchain-based trading platform. It quickly gained traction during COVID and the 2020 US Presidential Election. In 2022, Polymarket paid a $1.4mm fine and shut down US operations after the CFTC charged the company with not registering as an exchange. Polymarket subsequently shifted focus to offshore markets and began attracting a strong following among crypto enthusiasts.

Kalshi took a different, more compliance-friendly route, gaining the CFTC’s stamp of approval in 2020 to operate as a regulated prediction market exchange in the US.

Both roads quickly converged in 2024, when Kalshi successfully challenged the CFTC’s authority to block election contracts, paving the way to a natural expansion into sports. In July 2025, Polymarket acquired QCX, a small derivatives platform licensed by the CFTC, which cleared the path for a fully regulated return to American markets. Shortly after, Donald Trump Jr’s venture firm, 1789 Capital, invested in Polymarket, a clear sign that the Trump administration was re-writing the playbook.

Another catalyst for prediction markets was meeting consumers where they are: existing retail trading platforms. In March 2025, Kalshi partnered with Robinhood to offer event contracts through the Robinhood app. Piper Sandler analysts estimate that Robinhood users account for ~25% of Kalshi volume, with over 100 million contracts traded in week 1 of the college football season alone. Further analysis patients an even rosier picture to the economics:

Using Kalshi’s extrapolated volume for the third quarter of 2025 of 8,500 million contracts and assuming a 30% Robinhood share, the analyst models 2,550 million Robinhood contracts and $25.5 million in revenue, implying a quarterly run rate above $100 million and about $17.5 million for September

Zoom In:

The mechanical differences between a sportsbook and prediction market may be minor to the average person, but are very real. Let’s break it down:

At a traditional sportsbook, a bettor could wager $100 on Team X to win at +200 odds. If Team X wins, the sportsbook pays out $300 ($100 stake + $200 profit).

Prediction markets work differently. A bettor purchases or “trades” a contract that reflects the market-implied probability (e.g. 20%). Each contract purchased pays out $1 if the outcome is correct, and $0 if not. Users can buy or sell contracts at any time at the market price — even before the event settles – similar, but slightly different, than the “Cash Out” option on a mobile sportsbook slip as that is determined by the book itself.

The tl;dr? Prediction markets are peer-to-peer, where sportsbooks are you vs. the House.

All of this hype hasn’t come without its fair share of detractors. Critics notably question why prediction markets get a “free-pass” around legislative restrictions while offering the same types of bets as sportsbooks. The American Gambling Association has been a staunch opponent, describing Kalshi and Polymarket as "backdoor gambling schemes masquerading as 'financial products.” Both companies are also at the center of several state and federal investigations.

After being on the outside looking in on this prediction market boom, the sportsbooks have been forced to find their own unique entry points. FanDuel announced a prediction partnership with CME group in August, and DraftKings acquired predictions platform Railbird earlier this week.

The sportsbooks have been strategically quiet on some of the finer details: A [DraftKings] spokesperson told Front Office Sports that the company is "still evaluating whether to offer sports event contracts, and no decisions have been made at this time". Notably, these prediction platforms finally give sportsbooks a chance to operate in highly populated states like California and Texas, which have resisted sports betting legalization to date.

By the Numbers:

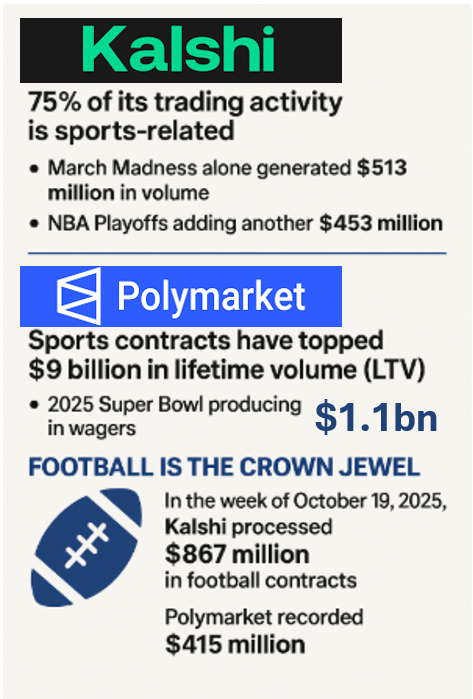

With football season in full-swing, both platforms are seeing record surges of volume (surpassing the previous records from the 2024 Presidential Election):

Kalshi and Polymarket valuations are skyrocketing as well:

Earlier this month, Kalshi raised a $300mm Series D that valued the company at $5bn. Meanwhile, Intercontinental Exchange (ICE, parent of the NYSE) invested up to $2bn in Polymarket at an ~$8bn valuation

Why the discrepancy in valuation?

Kalshi holds ~60+% of the global prediction market compared to Polymarket’s 37%; however, Polymarket’s crypto-native background and international user base gives it the current leg up in investors minds (valuation-wise)

Other eye-opening stats on the size of the market:

Source: Legal Sports Report; Brew Markets

An even more recent note from Piper Sandler analyst Patrick Moley said that sports are now driving about 90% of prediction market volumes on Kalshi.

Sports certainly are big business (Editor’s Note: h/t to Front Office Sports for that tagline)

The Bottom Line:

Prediction markets represent a head-on collision between opportunity and innovation. Kalshi and Polymarket entered the market at the perfect time, capitalizing on a gamified world while exploiting regulatory gaps to offer consumers the widest array of ‘contracts’ (not bets!). Morality aside, the market continues to grow as bigger players chasing the hype and enter the space.

While nobody can say where the regulatory landscape will take prediction markets, No Huddle believes:

Pushback will continue: many states have invested significant political and financial capital to legalize gambling and won’t want to lose out on tax revenue from it

Maybe a middle ground would be adding some form of tax on prediction market platforms (currently they are exempt from most state taxes as they fall under federal purview)

Media attention is not going away: thanks to Chauncey Billups, Terry Rozier, and the many media/social accounts that cover the betting world, you will be hearing about the sports betting landscape will remain front-and-center — whether you want to see some celebrity’s Sunday parlay or not!

Trust and transparency will win: the winners will be those who meet consumers where they already feel comfortable. Partnerships like Kalshi and Robinhood drive trust, transparency and expansion; expect others to try similar strategies

Gamification and optionality: Since prediction platforms are structured as contracts, consumers have full flexibility to trim, hedge or swap positions whenever they want. Gamification and optionality are major drivers of growth and customer retention, and prediction markets have both down.

Editor’s Note: I can finally bet on the holy trinity of parlays: Drake Maye MVP, Apple to release a new VR headset in 2025 and that there will be more than 4 inches of rain in NYC this month?... what a world we live in!

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

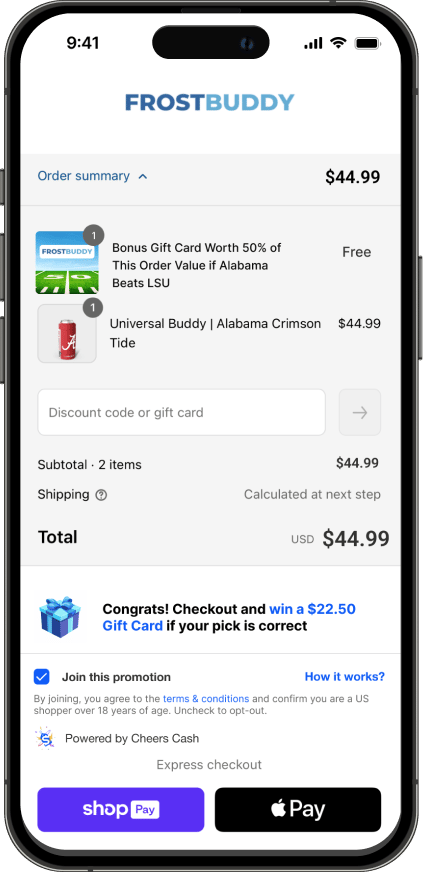

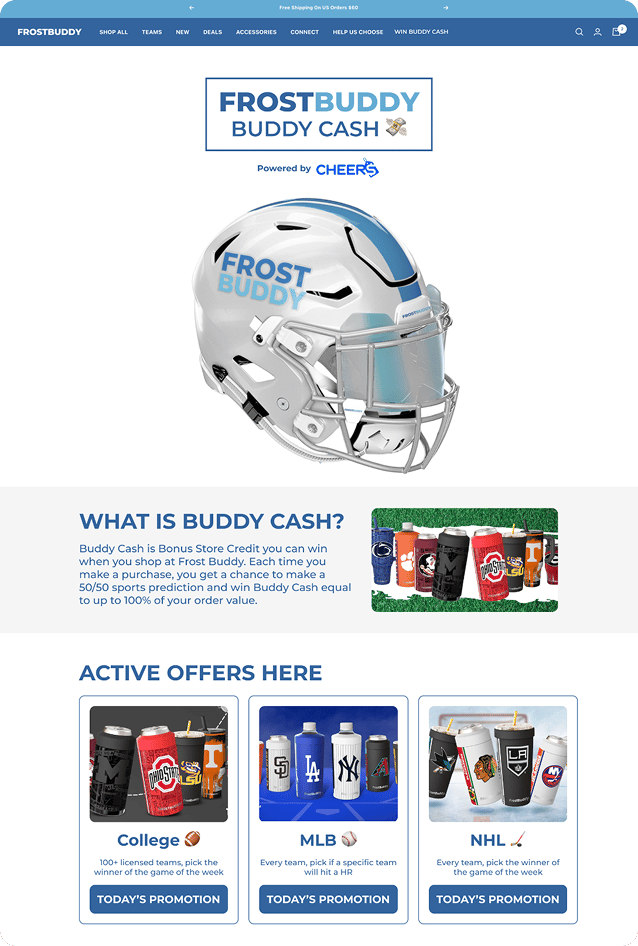

The Company: Cheers Cash

The Business in a tweet: Cheers Cash merges fintech with fandom by helping brands drive customer loyalty with Buy Now, Win Later rewards. Think Mattress Mack folded into a brand currency that keeps customers coming back for more.

The 101:

Industry: FinTech/Martech

Headquarters: New York, NY

Year Founded: 2024

Founding Team/Current Leadership:

Drew Cousin, Co-Founder: Previously scaled fintech education platform BlockBeam to 80+ universities and sold, leads sales, shoots midrange jumpers

Ford Cousin, Co-Founder: Previously SpeedChain, leads clients operations, doesn’t sleep, dunks basketballs

Andrew Barba, Technical Advisor: Former CTO at Barstool Sports, former Head of Product at TableList

Employees: 4

Fundraising Status:

Family-friends w/ participation from Dorm Room Fund → About to Raise Pre-Seed

Business Model:

Two-for-one revenue generation:

Commissions on powered sales

Traditional SaaS model (typically on a recurring monthly basis)

Traction:

Will hit $1m monthly GMV within 5 month of launching new loyalty product

Working with some of the fastest growing sports brands including powering the full loyalty programs tied to fandom for CardVault By Tom Brady (Tom’s trading empire opening up stores at every major sports venue) and Frost Buddy (the new Yeti, expected $60m+ sales in 2025)

Clients have said they want to “educate 100% of traffic on the Cheers Program” because of the loyalty flywheel it creates

Cheers Cash believes that every big brand will be a sportstech company, and that there will be a need for interoperable loyalty currencies that can scale across ecosystems (ex. Pats fans earning Pats loyalty cash when they shop at sponsor Dunkin)

Deep Dive:

Pros:

Niche market, but a huge one that isn’t going away. Loyalty platforms are nothing new, but the Cheers Cash entry point into sports brands is fast-growing with unique opportunities to tie rewards to the action on the field

Other established platforms are too spread thin, Cheers Cash focuses on bringing the best product to match each client’s needs

Real, low-friction opportunity to apply tech to a mechanic that has already been proven out in the real-world. Conditional rebate promotions are tried and true; already powered hundreds of millions in sales

The Cheers Cash flywheel: early clients want to push all customer traffic towards Cheers Cash → boosts ROI → increase sales → more opportunities outside of the ecosystem

Massive leverage for marketing teams with case studies to prove it

Cons:

Cheers Cash is solely dependent on performance. They win when brands win. The GMV model aligns Cheers Cash with program growth, which only happens if/when partners scale

Potential different regulatory environments outside of the US will require additional investment

Head2Head:

📶The Signal (No Huddle’s Take):

Buy now. Win later. Now that’s a proposition we can get behind.

We see Cheers Cash the early leader in a brand new vertical of the sports world — the blend of fandom, gamification and fintech. Cheers Cash is pioneering these core pillars in the booming sports world. As sports continues to evolve and grow as an asset class, brands, teams, leagues will be laser-focused on optimizing their loyal fanbases and keeping them coming back for more. In a fragmented world of socials, streaming, DTC, and more, Cheers Cash meets the consumer at the point of sale, granting them a free roll of the dice to earn future rewards.

When we look at who we think will be the stars of tomorrow, we love to see a value proposition that’s a win/win/win for stakeholders in the flywheel:

Cheers Cash wins when customers buy products and use the platform

Brands and partners win when they can 1) learn more about their customers 2) boost conversion rates (no more keeping that Roman Anthony jersey in the cart!) and 3) keep customers coming back for more

Consumers win by getting a free chance at a future discount if their selection is correct

Another angle love here at No Huddle is the marketing and data play. Cheers Cash helps companies automate their daily and weekly promotion cycles, keeping content fresh and targeted. Cheers Cash can also transform key activation opportunities into loyalty programs, boosting the LTV across the ecosystem.

Cheers Cash has proven its product-market fit. Now it’s time to grow. We’re excited to see all of the upcoming partnerships and opportunities ahead. And once the No Huddle custom merch drops… you better believe you’ll have a chance to use Cheers Cash when checking out!

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.