⚡ The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

No Huddle readers are well aware that the sports industry finds itself at a pivotal crossroads. If you look at recent headlines, you’ll see a wave of recent ownership stake sales, new stadium plans, record breaking contracts and your grandpa asking “why are sports so hard to watch now??”.

But what really powers sports business?

It’s fans like you and me. Take it from Marc Lasry, CEO of Avenue Capital Group and former Milwaukee Bucks minority owner, who recently told CNBC “You only make money in sports three ways: ticket sales, sponsorship and media”. All three of those pillars ultimately depend on fans. Fans are the ones buying tickets, tuning into broadcasts, and engaging with sponsors — whether that is at home, on mobile, in bars or anywhere else.

Why it Matters:

Fan spending is the backbone of the $521bn global sports industry and the key driver behind its 8% average annual growth.

Let’s look at one core phase in the world of fandom: tickets. Fans do more than buy tickets when they are released — those who miss out or decide later on to go to a game have sprouted an entire industry of secondary ticketing marketplaces. Huge players like Stubhub, SeatGeek, Gametime, Tickpick, Ticketmaster all now play a integral role in the overall fan experience.

Fan engagement goes far beyond the turnstile though. Globally, over 23% of sports fans stream live events online, and among Gen Z, nearly half multitask and use social media platforms while watching games (Greenfly). This constant evolution in viewing and engagement habits hasn’t gone unnoticed by leagues. NBA commissioner Adam Silver recently faced backlash for describing the NBA as a “highlights-based league”, not long after closing a record 11-year, $76bn media rights deal in July 2024.

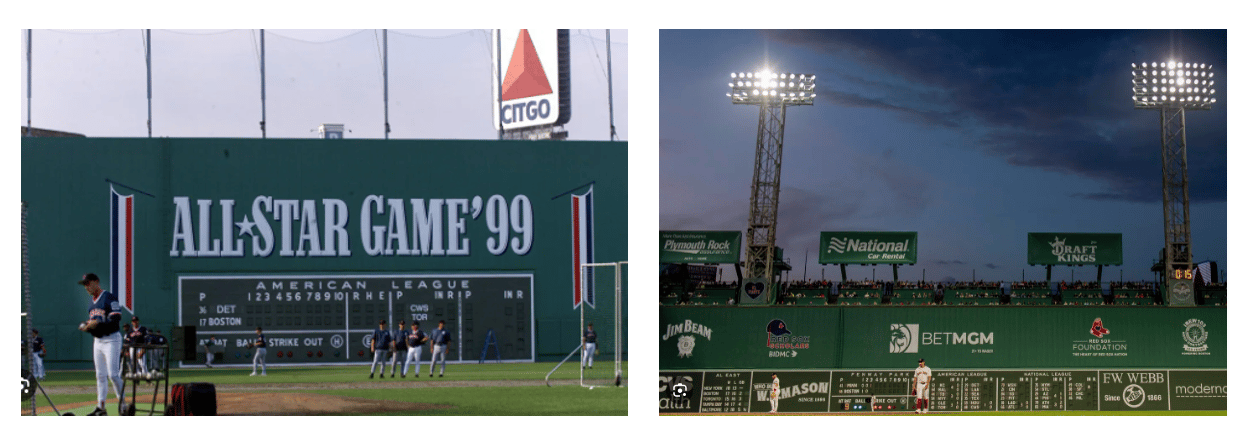

With so many eyes on the game, it’s no surprise that media rights fees and sponsorship spend continue to soar — companies want to be where the consumer is. Just look at how the Green Monster has evolved from a simple scoreboard to a billboard for brands:

Fenway Park’s famous Green Monster in 1999 vs 2025

The Big Picture:

With fans being so central to team valuations, organizations are ramping up efforts on delivering premium experiences — sometimes just as a means to justify the rising costs of tickets, concessions and merchandise. You’ve seen in No Huddle Volume 7 what premium hospitality operators like On Location can offer, but teams themselves are innovating with extravagant concessions, discounted family deals, season-long packages and memorabilia giveaways to deepen fan loyalty and engagement.

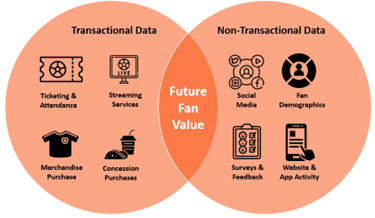

Fan loyalty is the lifeblood to any team. To keep fans coming back, many organizations are modernizing their approach to analyzing not just what fans buy (transactional data), but also how they interact across platforms and channels (non-transactional data). Analysis from iSportConnect digs into the lifetime value (LTV) of a fan — what they spend and how engaged they remain, both of which can help lead to new opportunities and revenue for teams and leagues.

Historically, teams have relied on third-party data for game-day preferences and transactional insights. Now, we’d expect to see a surge of teams building in-house analytics groups to focus on holistic fan data, prioritizing retention, personalized engagement and premium/memorable experiences.

A common refrain among sports executives is that the industry is “recession-proof”. Arctos Partners expands on this thesis, noting that North American sports have several key characteristics that to tie economic resiliency:

high utilization rates and pricing power in-line with (or even more) than inflation

a demand curve that is relatively inelastic

ticketing revenues that grew during the Global Financial Crisis

While no industry is completely immune (as shown with COVID), North American sports in particular are uniquely resilient.

Zoom In:

A major theme we’ll keep covering at No Huddle is the technological gap in the sporting industry. As sports mature into a true liquid asset class, most teams and leagues still lag behind peers in tech, entertainment and retail. Recent Morgan Stanley research estimates that the sports industry could boost annual sales by 25% ($130bn) simply by accelerating technology adoption. Case in point: only 30% of sports companies use tech-driven marketing campaigns versus 92% in retail.

Progress is happening, especially at newer venues and in tech-forward franchises. Some of the newer stadiums deploy IoT sensors for real-time data on crowd behavior, lines, merchandise demand and more. The NFL has gone fully digital with ticketing — fans now download tickets via team or ticketing apps. On the payments side, over 95% of stadiums are now cashless. This shift not only streamlines operations but also boosts revenue and accelerates transactions to help improve the overall fan experience.

By the Numbers:

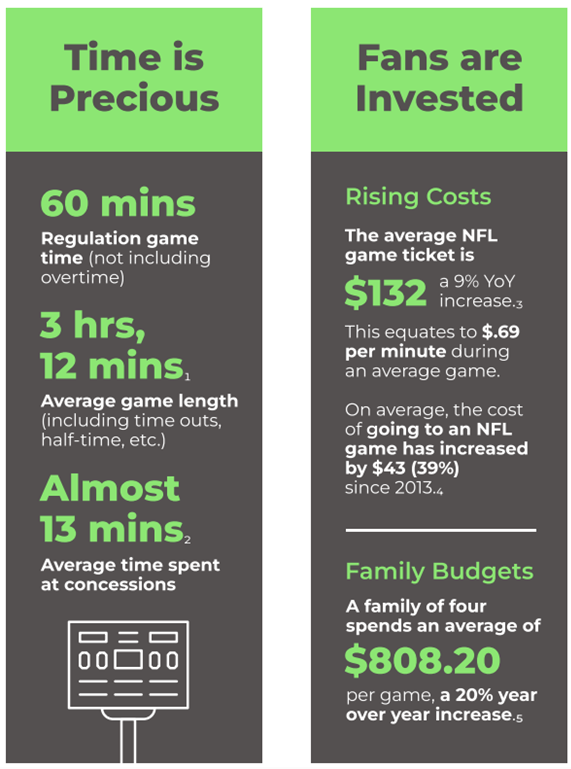

These technological advancements offer clear wins for both teams and fans. Teams gain actionable data and more revenue, while fans benefit from smoother, faster and less disruptive game-day experiences. Mashgin’s NFL fan experience report paints a clear picture of the fan experience today, and the opportunity cost associated with each step of the flywheel.

The report also reveals some interesting tidbits:

Median transaction times at Mashgin kiosks are under 15 seconds, saving fans 6.3 million collective minutes in just the 2024 NFL season

79% of fans say they’ve missed crucial plays waiting in line, and 80% have abandoned a line due to wait times

Stadiums using this AI-powered checkout system see higher revenue: BMO Stadium reported a 20–25% sales boost after adding Mashgin kiosks, mainly due to faster, frictionless sales

The takeaway? Fans arrive ready to spend at sporting events, and every technological upgrade is an opportunity for teams to elevate the experience… and encourage more spending. Those who prioritize advanced tech not only deliver smoother and more memorable game days, they also unlock new revenue streams and stronger fan loyalty.

The Bottom Line:

Fans are the heartbeat of sports — they are what turn good moments into unforgettable experiences. Just look at this weekend’s slate: the Ryder Cup, Penn State’s record setting White Out game (111k+ fans), the always passionate NFL fans and the drama of MLB playoff race. All demonstrate how fans create the electric environments that we associate and love about sports.

While fans have always made sports special, teams are only now really embracing broader technology to upgrade these environments and unlock new ways to monetize passionate fans. Innovations in stadium experience, digital engagement and personalized offerings are making it possible to reward fan energy and also drive strong outcomes for teams.

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

The Company: Jump

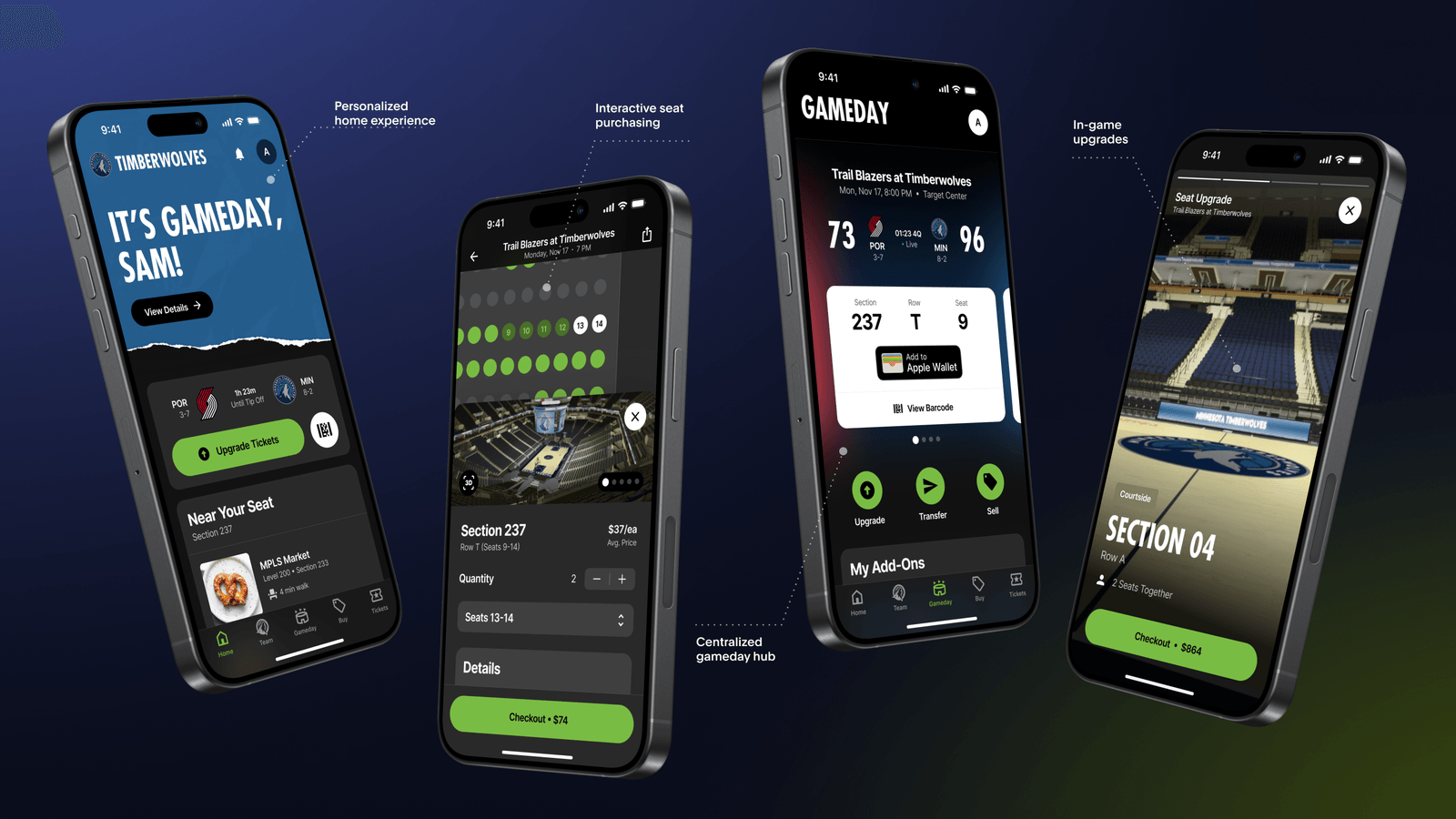

The Business in a tweet: Jump is revolutionizing how professional sports teams engage with fans by replacing antiquated systems and building the “shopify for sports teams”. Jump’s unified fan experience software platform combines ticketing, merchandise, concessions and operations into one system, helping teams own their fan relationships and unlock new revenue streams. When fans enter the Jump platform, they enter a one-stop-shop full of ticketing logistics, dynamic pricing, discounts and upgrades.

The 101:

Industry: Sports Technology / Fan Experience Software

Headquarters: New York, NY

Year Founded: 2021

Founding Team/Current Leadership:

Jordy Leiser - Co-Founder & CEO

Marc Lore - Co-Founder

Alex Rodriguez - Co-Founder

John Ernsberger – CRO

David Blanke – CFO

Employees: ~50

Fundraising Status:

Raised $25mm* Series A at a $100mm valuation in August 2025 led by Seven Seven Six

Other notable investors: Courtside Ventures, Forerunner Ventures, Will Ventures, Drive by Draftkings

Have now raised $60mm to date

Business Model:

Through a hybrid SaaS / revenue sharing model, Jump facilitates an end-to-end fan experience platform, allowing the team to be a part of the process every step of the way.

How do they make money?

Annual licensing fee based on teams and venue size

Commission of 1-5% of all transactions processed through the platform, including merchandise, concessions and ticketing

Zero fees charged to fans

Traction:

Current ARR: estimated to be~$10mm

4 teams signed: Minnesota Timberwolves (NBA), Minnesota Lynx (WNBA), North Carolina Courage (NWSL) and North Carolina FC (USL)

Deep Dive:

Pros:

Growing market: global sporting event ticket market valued at ~$15bn in 2022 and projected to reach ~$40bn+ by 2030 (Grand View Research)

Unique value proposition addressing critical pain points and outdated systems that haven’t evolved with other sports-related technological advancements

Fragmented systems: teams currently use a number of vendors for different aspects of their event business (ticketing, merchandise, concessions), Jump unifies all of these into one platform

Lost fan relationships (or lack thereof): Teams did not have a way to learn more about their fans’ interest, buying patterns and customizations until now - Jump allows teams to own all the fan associated data

High Fees - Ticketmaster, Live Nation and other platforms charge fees to consumers (and are facing antitrust scrutiny), Jump doesn’t

Revenue leakage: using several vendors reduces profit margins for teams while Jump’s all-in-one solution can also lead to cross-selling opportunities, dynamic pricing and personalized offers to fans

Flexibility with relentless commitment to the sports vertical: Jump is focused on solving the issue in sports and sports only

For example: the Target Center in Minneapolis will continue to use AXS for concerts and shows while using Jump for all things Timberwolves & Lynx

Cons:

Sporting executives can be slow adopters to new technology

Still very early days of proof of concept – just 4 clients so far

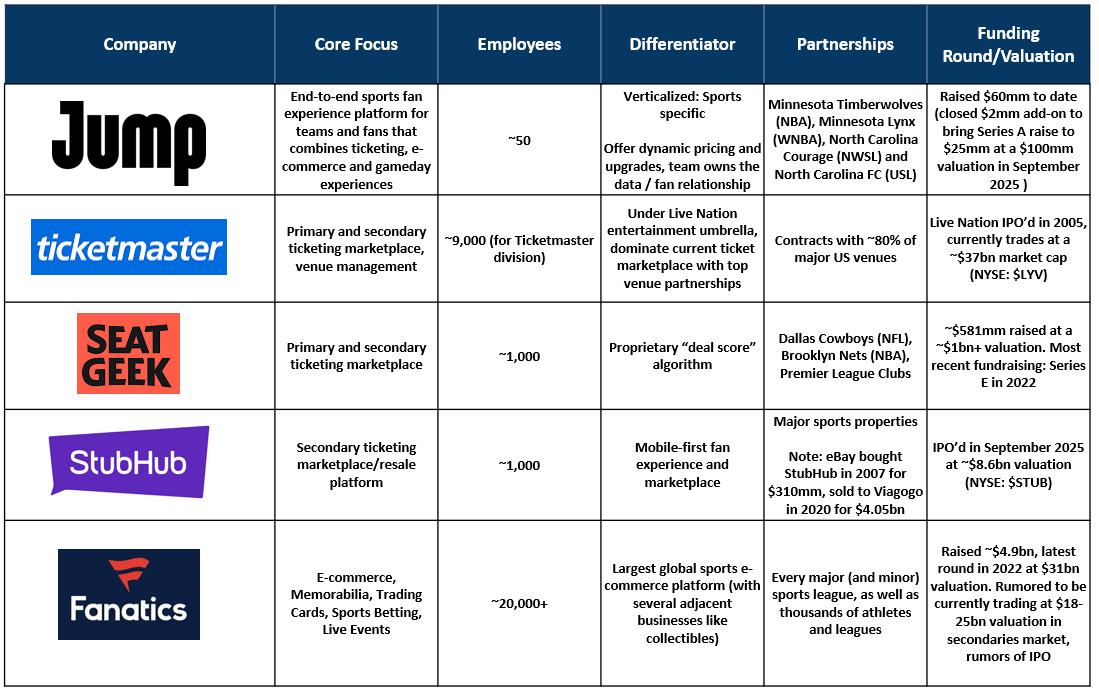

Comparables:

📶The Signal (No Huddle’s Take):

When it comes down to it, sports are all about the fan connection and live community — a powerful source of meaning in our increasingly digital world. At No Huddle, we believe in companies that prioritize the end-user experience above logos, partnerships, or headlines. In this respect, Jump stands out as a leader poised to propel the next wave of technology adoption for teams and fans alike. We’re keeping a keen eye on Jump’s expansion, and look forward to using their platform in an upcoming gameday experience.

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.