Editor's Note

Welcome to the first edition of No Huddle.

⚡ The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

Sports team valuations are skyrocketing. We all see the headlines and do a quick double take: the Celtics just sold for $6.1bn ($7.3bn blended cost), a minority share of the New York Giants is expected to go for a record price (and maybe to a group led by Eli Manning). The yearly Forbes valuation charts continue to soar. How did we get here? What happened to being able to sit on your couch, flip through a few channels and watch all of your local teams? As the media landscape continues to evolve, which levers may be pulled to keep these valuations trending up and to the right?

Why it Matters: It’s hard to miss all of the action nowadays surrounding the business of sports — aside from the ownership sales, we have also seen the Commanders and DC agree to a $4bn deal to build a new stadium and we continue to see the largest contracts in each leagues history seemingly every offseason (hat tip to Juan Soto). The reason for all of this craziness? The soaring cost paid for media rights. You may ask — how and why do these media (and tech) companies continue to pay a premium for sports rights? Well, they know that sports is the best way to obtain and maintain subscribers. Peacock’s first big foray into the NFL — an exclusive playoff game — led to 2.5 million net new subscribers in a single-day, and 60% of those subscribers remained active a year later. For better or worse, sports are probably the main reason why you pay for Cable, or YoutubeTV, or Paramount+, or Max, or Netflix… (Editor's Note: Entourage reruns also serve as a totally valid reason to subscribe to Max)

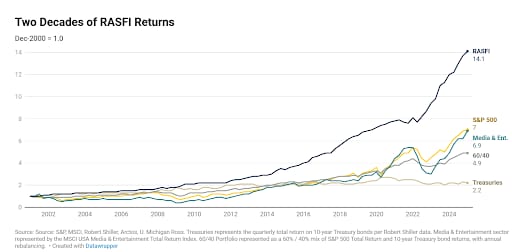

The Big Picture: Sports have not always been a booming asset class. Just 20 years ago, teams and league development came to a standstill - Bain even tried to buy the entire NHL for ~$4bn! In the 1980s, Donald Trump said "I feel sorry for the poor guy who is going to buy the Dallas Cowboys. It's a no-win situation for him" after passing on an opportunity to purchase the Cowboys for $50 million (the Cowboys are now worth $10.1bn, and are the most valuable sports team on the planet). Even with the doubters along the way, media rights (and the loosening of rules around Private Equity ownership stakes) have pushed professional sports valuations to astronomical levels, and driven their outperformance vs. other common asset classes.

Source: Arctos RAFSI

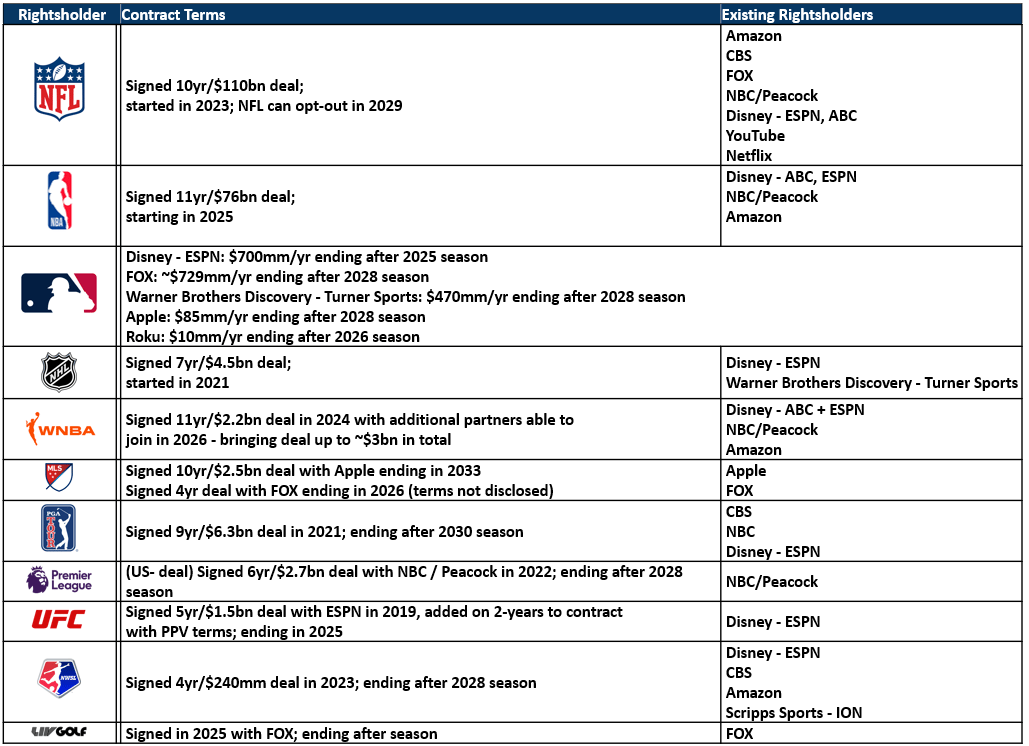

Zoom In: Each of the major US professional sports leagues have their own very uniquely structured media deals. As you can see in the chart below, both the NFL and NBA are heavily reliant on national media revenue, whereas other leagues have more of a blend between national and local media rights. (Note this chart is representative of the 2022-2023 seasons)

Source: Sportico

As depicted in the chart above, as well as the By the Numbers section below, the NFL is the king of the media rights landscape, with ginormous national deals driven by the scarcity (just 17 regular season games…as of now) and quality of the product. Because of the NFLs unique revenue-sharing, pass-through structure, each team is able to bring in the same piece of the media rights pie — no matter if they are America’s Team down in Dallas, or located in a much smaller market like Cincinnati. On the opposite end of the spectrum, the MLB’s media rights set up is much different (and currently being re-negotiated). Also notable is that the MLB is the only Big 4 league with no salary cap (just a luxury tax threshold). This allows teams in larger markets with bigger followings to spend more on their team, while taking advantage of the ability to have large regional media deals, high attendance numbers, numerous sponsorship opportunities, constant merchandise sales and more. Look no further than what the Dodgers are doing — taking advantage of the league structure to put together a super team that has been dominating headlines and the sport (12 straight playoff experiences and 2 World Series in the past 5 years).

By the Numbers:

Sources: Sports Media Watch List, Sports Business Journal, Sportico, Sportsball

Keep a close eye out for these upcoming media rights deals and how they will reset the market:

MLB

UFC

Formula One

Source: TVRev

The Bottom Line: Sports teams are sticky (maintain their value) and scarce. History says those two won’t change. Media rights will continue to anchor these valuations and the NFL will lead the way both in terms of an overall rights package, but also through innovating and diversifying their revenue streams. The NFL is known for pushing the envelop on this front, with notable recent strategic initiatives to sell more media rights including global expansion, Christmas Day games and early discussion of adding an 18th regular season game. Look to see other leagues follow the NFLs lead with similar moves to help keep valuations climbing.

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

The Company: Cosm

Source: Cosm

The Business in a tweet: Cosm is redefining live entertainment with massive LED domes that immerse audiences in “shared reality” for live sports, concerts & more. Cosm is expanding fast with venues already in LA & Dallas. A top-notch fan experience may no longer only be found at stadiums.

The 101:

Industry: Immersive Tech, Virtual Reality

Headquarters: Los Angeles, CA, with operating locations in LA and Dallas. Atlanta and Detroit venues slated to open in 2026.

Year Founded: 2020

Founding Team/Current Leadership:

Jeb Terry – Co-Founder, CEO & President

Devin Poolman – Chief Product & Technology Officer

Sheli Reynolds – Chief Administration & Strategy Officer

Kirk Johnson – COO & GM, Evans & Sutherland (A Cosm Company)

Employees: 500+

Capital Raising Status:

Achieved $1bn unicorn valuation in 2024 after closing a $250mm funding round

Expected funding use cases: expansion, technological developments and sales, other strategic media partnerships

Backed by notable investors including Marc Lasry, Dan Gilbert, Mirasol Capital, Bolt Ventures (David Blitzer’s fund), Baille Gifford

Business Model:

Sell game/event-specific tickets for fans to attend a Cosm location

Tickets go for as low as $11 for general admissions entry

Check out some of the upcoming events in LA here

Implement and integrate technology to other partners like planetariums, museums, higher education, theme parks and other urban spaces

Partner with leagues to bring highly differentiated content to the sports world

Early Traction: Cosm’s business spans three main verticals: Sports and Entertainment, Science and Education, and Parks and Attractions. Cosm has already partnered with the NBA, UFC, ESPN, NBC Sports, Turner Sports, FOX Sports and Cirque du Soleil to show live events at their locations.

Cosm’s flagship product is a massive curved LED screen — similar to that of a movie theater — that helps deliver a second-to-none fan experience. To date, Cosm has had events for live sports, concerts and other artistic content. The first Cosm venue opened in 2024 in LA. The 65,000 square foot venue has a 87 foot dome that can seat 1,700 guests. As one recent attendee of a Cosm event put it: “You feel like you are on the sidelines, but are actually at a bar.”

Deep Dive:

Pros:

Enormous market opportunity as consumer demand shifts to more engaging and over-the-top, trending experiences

Able to offer a more affordable, easy to get to option than attending a live sporting event (especially in large markets)

Leverage industry tailwinds and curiosity in the VR world / metaverse

Already secured strong partnerships with key stakeholders in the sports and entertainment world

Tech-first platform helps insulate overall business from being overly consumer reliant

Creating a new category in entertainment — first mover advantage

Cons:

Expansion will be capital-heavy (building immersive venues)

Can never replicate the true experience of being at a game

Selling a new category; will inevitably deal with a normal lag in consumer adoption

Expensive overhead (both location and technology costs)

Partnership agreements — could leagues flip to a more defensive stance in order to protect IP and the “true” gameday experience?

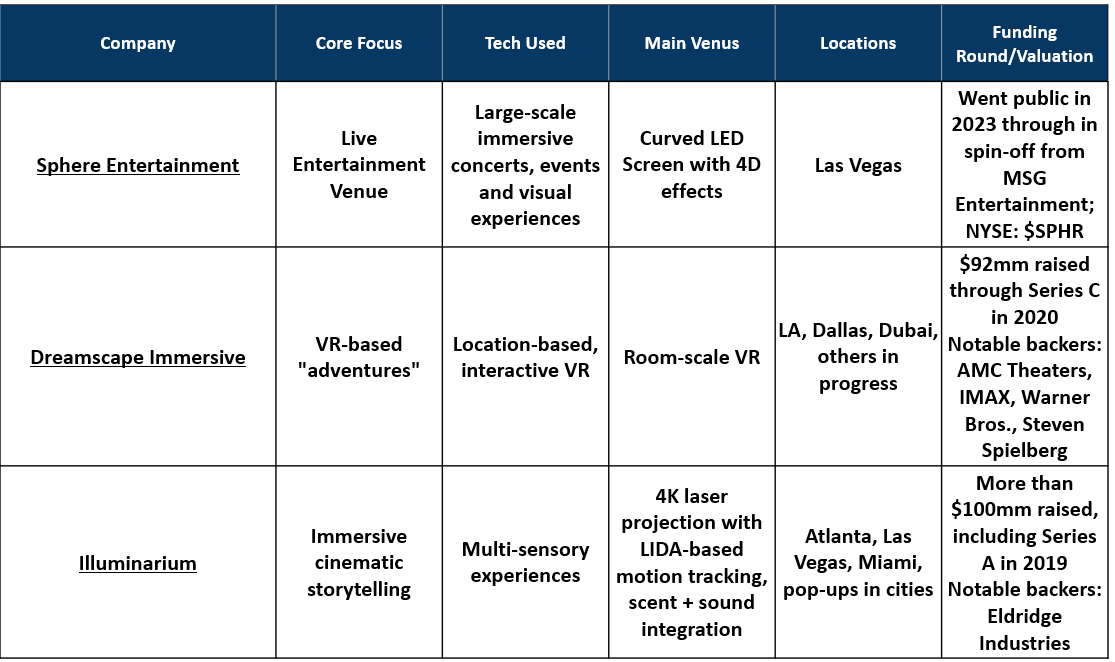

Comparables:

📶The Signal (No Huddle’s Take): We are all in on Cosm. As ticket and concession prices soar, there is a huge total addressable market of fans who still want the “feeling” of being at a game, but aren’t willing (or able) to pay the premium price. Cosm helps blend the two by creating an immersive experience that makes fans feel like they have sideline/courtside seats for a fraction of the cost. We are keeping a close eye on Cosm’s expansion - what cities do they target next? How will those cities adopt to having a new option to watch games? How will Cosm drive forward partnerships with respective leagues and other entertainment partners to stay on the cutting-edge of the sports tech world?

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.