Editor’s Note

No Huddle is proud to be an official partner of NOSOLO

NOSOLO is on a mission to improve mental heath awareness globally and remind people that they are never alone. NOSOLO donates 25% of all proceeds to the NOSOLO GIVE BACK FOUNDATION, a non-profit created to fund scholarships, school collaborations and community events. Nobody Goes Solo. NOSOLO.

5 referrals to No Huddle earns you a free NOSOLO hat of your choice (referral buttons below).

Spread the word and get some free merch for doing it!

⚡The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

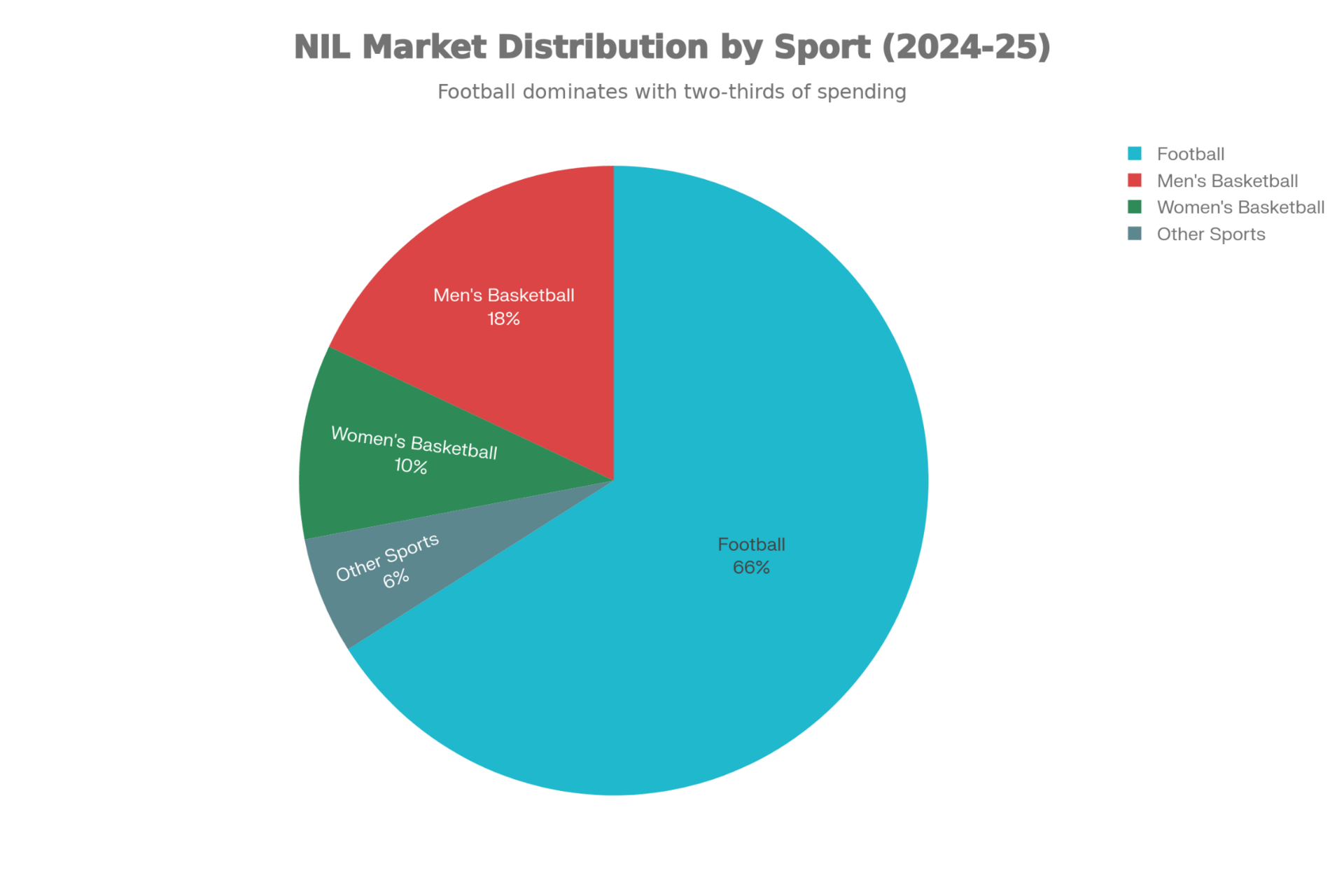

Free Agency. The transfer portal. Roster building. Core pillars of today’s sporting world, and the moments when teams, leagues, agents and players all come together to hash out the 0s and 1s. The landscape of sports management has morphed into a circus of complexity, with front offices and agents juggling budgets, evolving regulations and roster challenges that would have been unthinkable just a few years ago. From college athletic departments navigating revenue share, NIL collectives and the transfer portal (aka this whole week on Twitter) to pro teams playing salary cap gymnastics, the modern sports ecosystem is as elaborate as ever.

Outside team walls, power brokers like Scott Boras, Rich Paul and Jimmy Sexton have long understood the leverage that agents hold - often more than the teams themselves. These agents do more than negotiate contracts: they influence trades, orchestrate free agency moves, and, in today’s world, even help high school athletes monetize their brands before they set foot on a college campus. As the sports world careens toward an uncertain future marked by labor disputes, new revenue-sharing models, and an arms race for talent, understanding how all these pieces fit together has never been more critical.

Let’s jump in.

Why it Matters:

Well, if you care about championships for your favorite team or alma mater, this is really what it all boils down to. The behind-the-scenes, under-the-table, wink-wink scenarios that lead to the biggest player moves.

In college, athletic departments are rapidly evolving to be more business-oriented, now juggling fundraising, budgeting, retention, revenue sharing and more on top of the traditional coaching hires and recruiting cycles. For professional teams, the margin for error keeps shrinking: one bad contract can handcuff a franchise for years (see the Browns with Deshaun Watson and the Dolphins with Tua Tagovailoa).

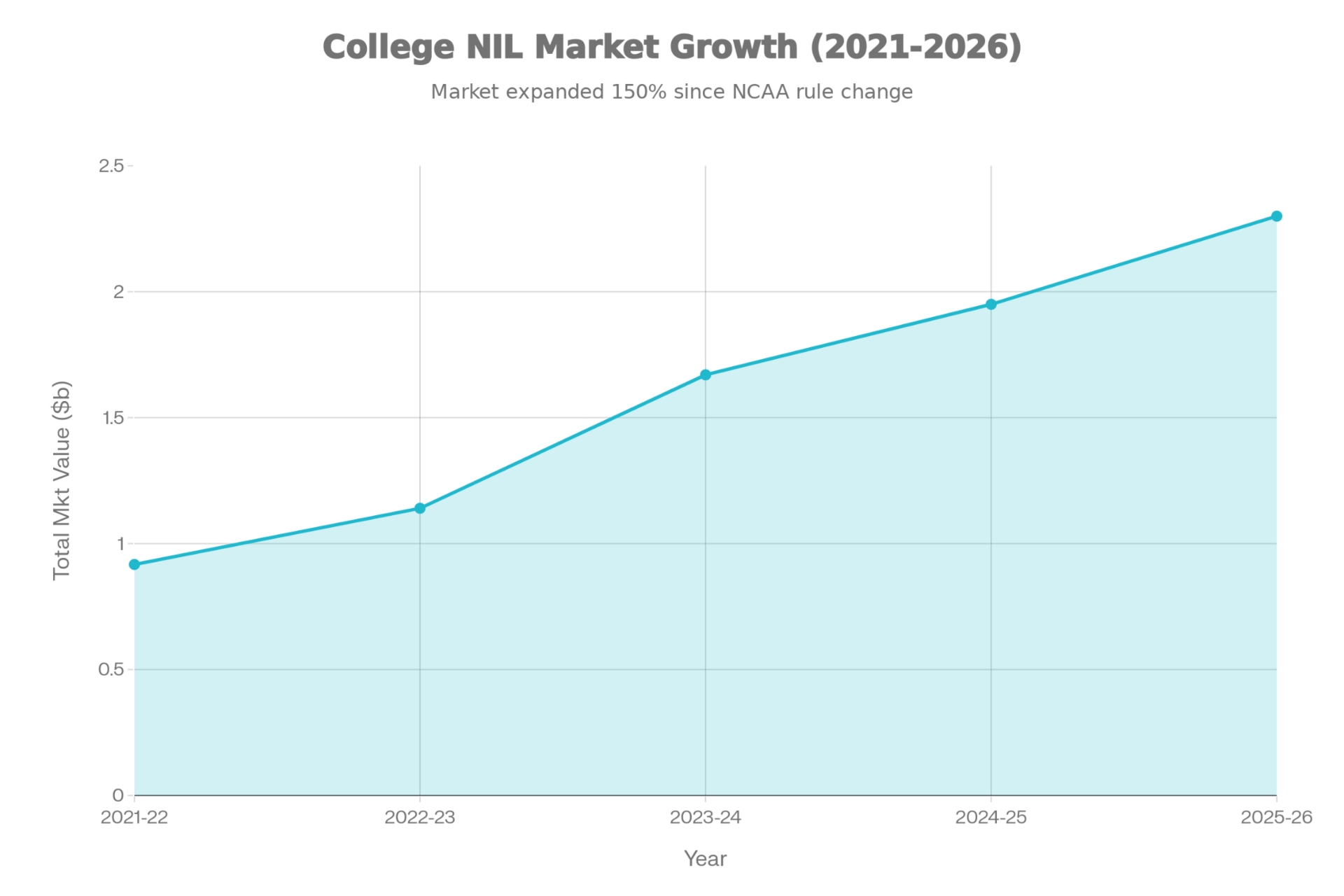

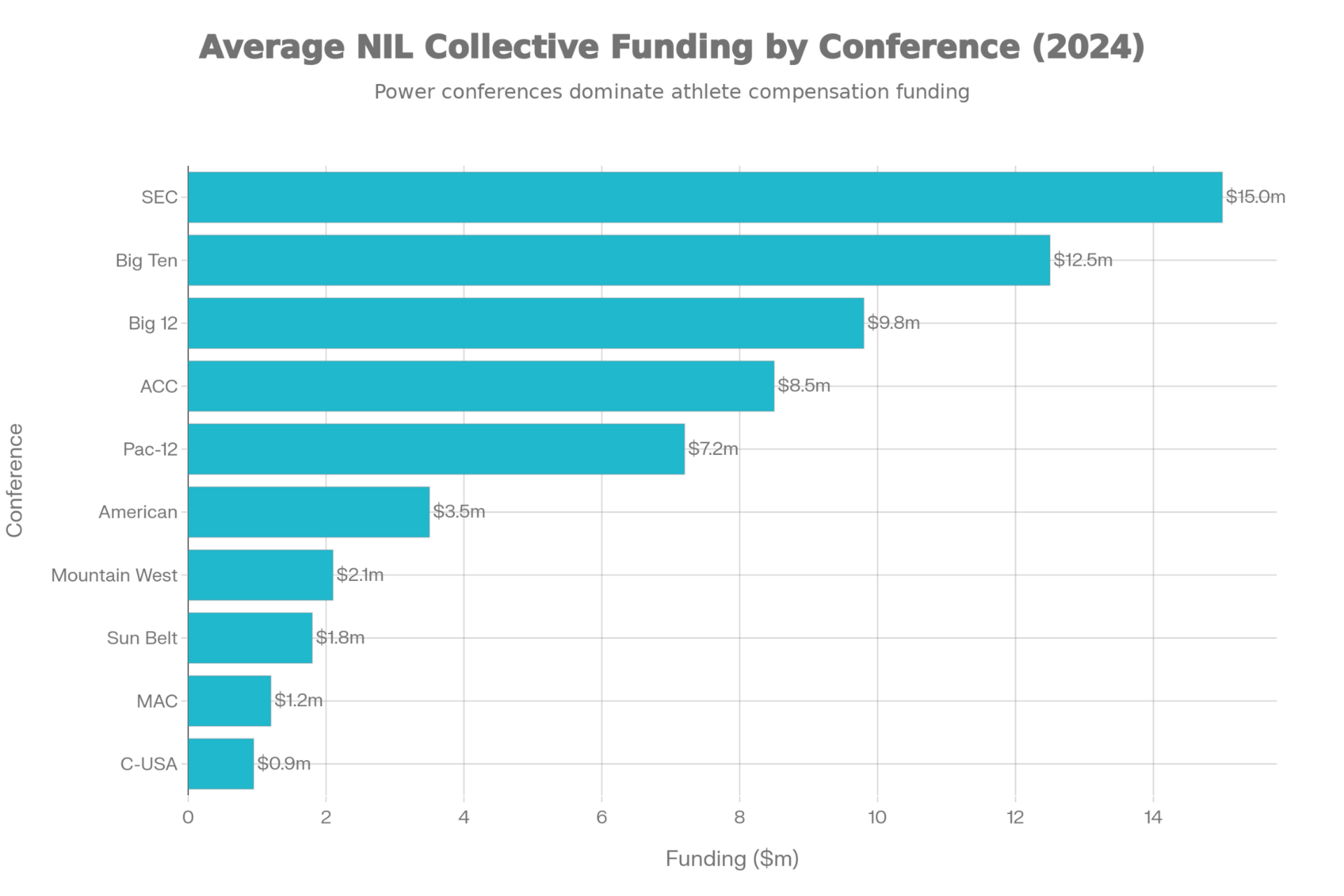

The stakes are enormous. In college sports, the NIL market continues to explode (see By the Numbers section). At the same time, professional leagues are watching their own financial landscapes shift:

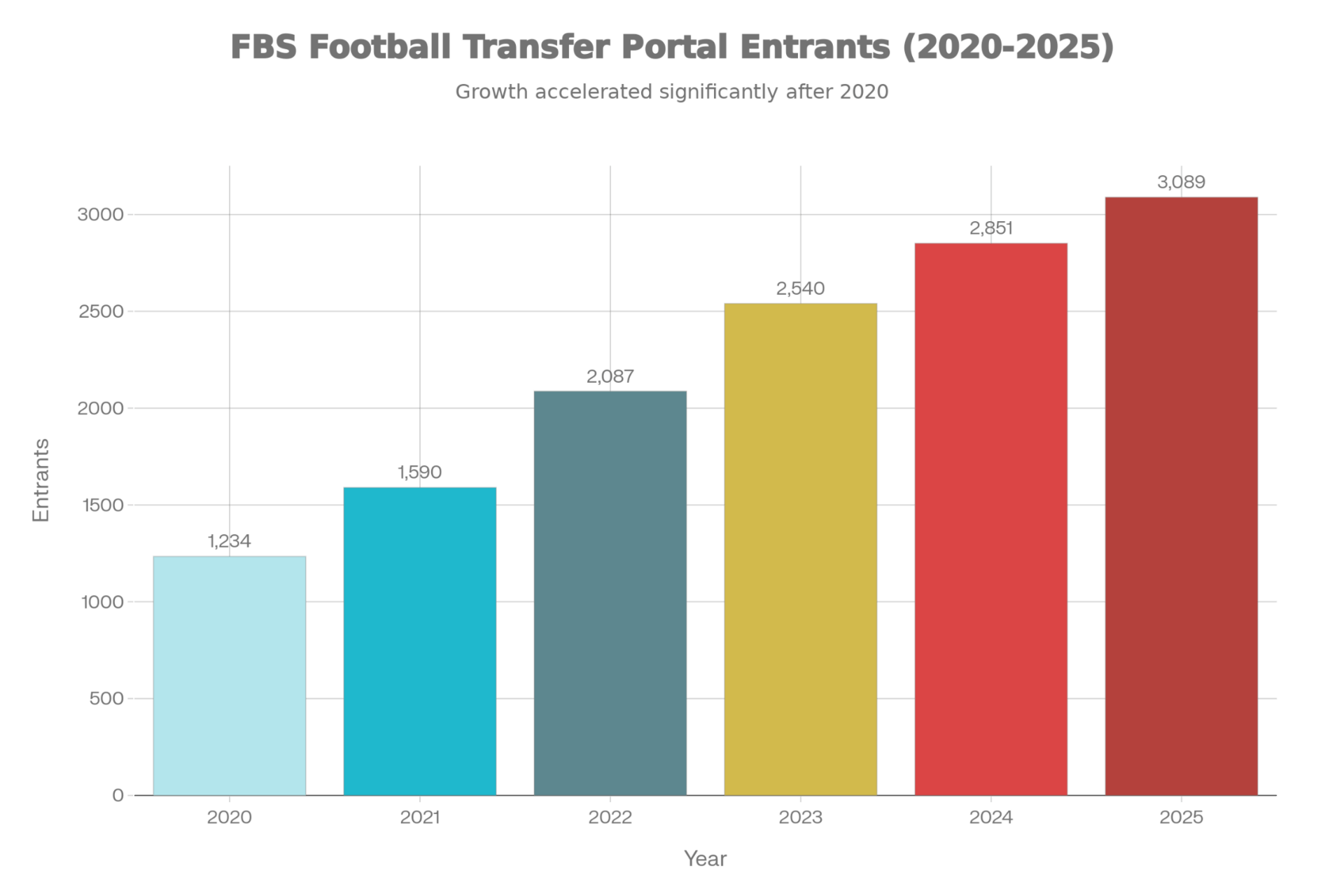

The human element matters too - and is often forgotten. Student-athletes are their own brands (and legally monetizable ones) from a young age, with high school and college players striking endorsement deals, building social followings and hiring representation. Players are commanding enormous NIL packages and leveraging loose transfer-portal windows and rules to maximize their compensation. We’ve even seen former professional athletes be granted collegiate eligibility and joining teams midseason, a once unthinkable twist to the system.

Coaches are under immense pressure to not only win and appease athletic directors, board members, trustees and boosters, but also retain their rosters and withhold a strong brand for their school. In addition, agents are now working the phone to get their clients the best deal. Agents are working the phones constantly to get their clients the best possible deal. Just this week, Washington QB Desmond Williams attempted to exit a deal he signed to return to the Huskies after presumably finding greener pastures elsewhere, prompting Washington to push back and explore legal options. A messy breakup is expected - much like the saga that ended with former Tennessee, now UCLA, QB Nico Iamaleava finding a new home after months of NIL-related drama last offseason. It doesn’t take a true detective to connect the dots and see that some agents may be willing to bend or break the rules in order to do what is best (at least financially) for their clients.

The Big Picture:

As systems and structures evolved, many teams and athletic departments failed to modernize their own operations. Things quickly became fragmented and outdated.

The transfer portal now has thousands of entrants (see By the Numbers section), but relies on clunky tools to sort, track and contact players, making real time roster management feel archaic. On the NIL side, No Huddle has already covered how the NIL GO system has been plagued with delays and confusion. The burden on coaches - many of whom have little to no formal business experience - is now tenfold. That’s before even accounting for poorly structured transfer windows where players participating in the College Football Playoff must decide whether to stay or leave while still preparing for the biggest games of their seasons.

Even with all these hurdles, the money keeps flowing in. In just the past few weeks, headlines have ranged from Mark Cuban pumping more NIL money into his alma mater Indiana to support the 2026 transfer-portal cycle, to reports of players being nudged out the door and told they needed to transfer to free up budget space. There has even been a subtle paradigm shift: fans and boosters now watch games with the market in mind, and the result is a system with very little loyalty left. Look no further than Jets star and OSU alum Garrett Wilson, who not-so-subtly called for his Buckeyes to go out and pay for a better kicker after their loss to Miami in the CFP.

As you can imagine, the professional sports side deals with its own version of challenges - though things are much more buttoned up than what’s happening on campuses across the US. Each league is constantly balancing salary cap rules, roster constraints, and long term contract commitments, while agents and front offices cut mega deals and craft creative contract terms.

Zoom In:

Like many topics No Huddle covers, this world of player management and negotiation world is deeply fragmented. There are still very few reliable, systematized ways to properly track and manage all of the puts and takes of scouting, contracts and roster moves at either the college or pro level. This burden has started to reach unsustainable levels both financially and on the human side.

Amidst that chaos, agents have emerged as the ultimate power players, wielding influence that expands far beyond simple contract negotiations. Scott Boras has been one of the loudest voices pushing back on any move toward a hard salary cap in the MLB, while Texas head coach Steve Sarkisian has publicly called out the illegitimacy and irrationality of agents in the college world nowadays. The main takeaway: Agents have to deal with the same broken landscape as everyone else, just under a different rulebook and pandemonium.

The agent's role has also expanded dramatically in the NIL era, and so have the adjacencies. Companies like Article 41 are effectively turning student-athletes into brand-ready creators, already working with schools like UCLA and UNC to help athletes build their digital presence and execute campaigns for national brands.

By the Numbers:

The Bottom Line:

The convergence of NIL, the transfer portal and the player-driven changes in the pros has turned agents into even more powerful stakeholders than ever before. Traditional approaches and management tools are straining under the weight of this new reality, and every stakeholder group is scrambling to adapt to the next iteration of sport as we know it.

The fragmented, high-stakes nature of modern sports management now demands integrated tools that can track rosters across high school recruiting, transfer-portal activity, and professional free agency, while also modeling salary cap and NIL budgets in real-time. Layer on top the compliance demands from the NCAA and pro leagues, plus the coordination required between other stakeholders (coaches, GMs, agents, and collectives) and building a winning team/program isn’t as easy as your Grandpa on the couch may think.

Without these kinds of tools, decision makers at every level will keep operating reactively and making decisions based on incomplete information, while better organized competitors quietly gain edges through cleaner data, tighter coordination and communication.

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

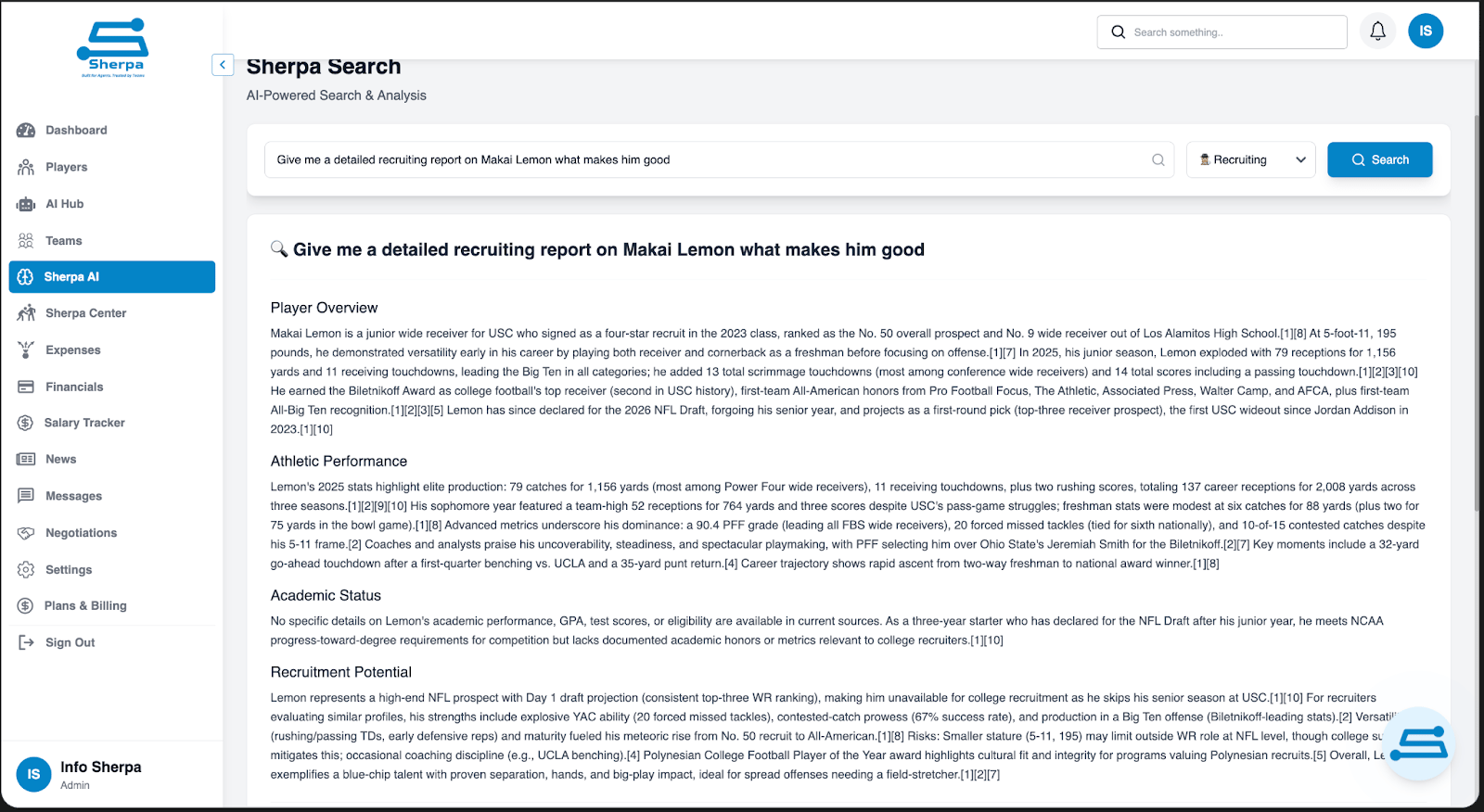

The Company: Sherpa Sports

The Business in a tweet: Sherpa is the first AI-powered Player Relationship Management (PRM) platform built for the entire organized sports ecosystem: agents, teams, and athletes. Sherpa centralizes scouting, NIL deal flow, contracts, and compliance into one secure, verified operating system.

The 101:

Industry: Sports Technology | Sports Analytics | AI Software (SaaS)

Headquarters: Remote-first, US-Based

Year Founded: 2024

Founding Team/Current Leadership:

Darrick “DJ” Johnson — Founder & CEO

Former professional athlete and sports agent with a strong enterprise technology background.

Rashaad Reynolds — Chief Revenue Officer (CRO)

Former NFL athlete with deep experience in enterprise sales and go-to-market leadership.

Lakevious Battle — Chief Technology Officer (CTO)

Former Division I athlete and enterprise cloud engineer with expertise in scalable, secure platform architecture.

Julian Dowell — Chief Product Officer (CPO)

Former founder and product innovator who created one of the first 3D learning libraries, redefining how students engage with educational content.

Employees: 4 (lean team; mix of internal leadership + development resources)

Fundraising Status: Currently raising a Friends & Family round to scale product and GTM momentum. Min Check Size $10,000 - Raising 2 Million Dollars - Reach out to the team at [email protected] for more information

Business Model:

B2B SaaS + enterprise pilots

Sold to teams, athletic departments, conferences, and sports agencies

Annual platform subscriptions + enterprise agreements

Add-ons/modules for intelligence packs (e.g., scouting, roster strategy, NIL, contracts, financial analytics, edge video)

Offers a flexible, fully configurable solution built around each customer’s workflows, data, and goals.

Traction:

Early traction across NCAA programs, professional teams, conferences, and sports agencies, validating demand beyond NIL-only use cases

10+ active beta customers, multiple signed LOIs, and a $2M+ qualified pipeline generated in ~90 days

Engagement from senior decision-makers including athletic directors, general managers, and conference executives

Consistent weekly usage across AI scouting, roster and transfer intelligence, NIL analysis, and contract evaluation

Inbound interest driven by conference-level conversations and referrals, not solely outbound sales

Clear expansion path from single-team pilots to multi-school and conference-wide deployments, supporting scalable enterprise growth

Deep Dive:

Sherpa is the AI intelligence layer for sports—designed to sit across and enhance existing sports software ecosystems.

Rather than replacing current tools, Sherpa connects data, workflows, and insights across scouting, recruiting, roster management, NIL, contracts, and finance, enabling organizations to make faster, smarter decisions through a single AI-driven interface.

Pros:

Clear wedge: “AI front office” intelligence layer (not just another workflow tool)

Multi-sport + multi-level (pro, college, high school, agencies)

Currently in an arms race - teams are more willing than ever to try new systems to track and get a leg up on each other

Working directly with decision makers at each stakeholder (conferences, teams and agents). Getting a foot in the door with the right people can boost adoption quickly

Strong partnership-led GTM potential (conferences, data partners, tech partners)

Early pipeline momentum relative to stage - performance on these initial programs can lead to widespread usage

Founder-market fit: led by former professional athletes and enterprise tech leaders (sales, product and engineering), the lean-team has the right background to win

Cons:

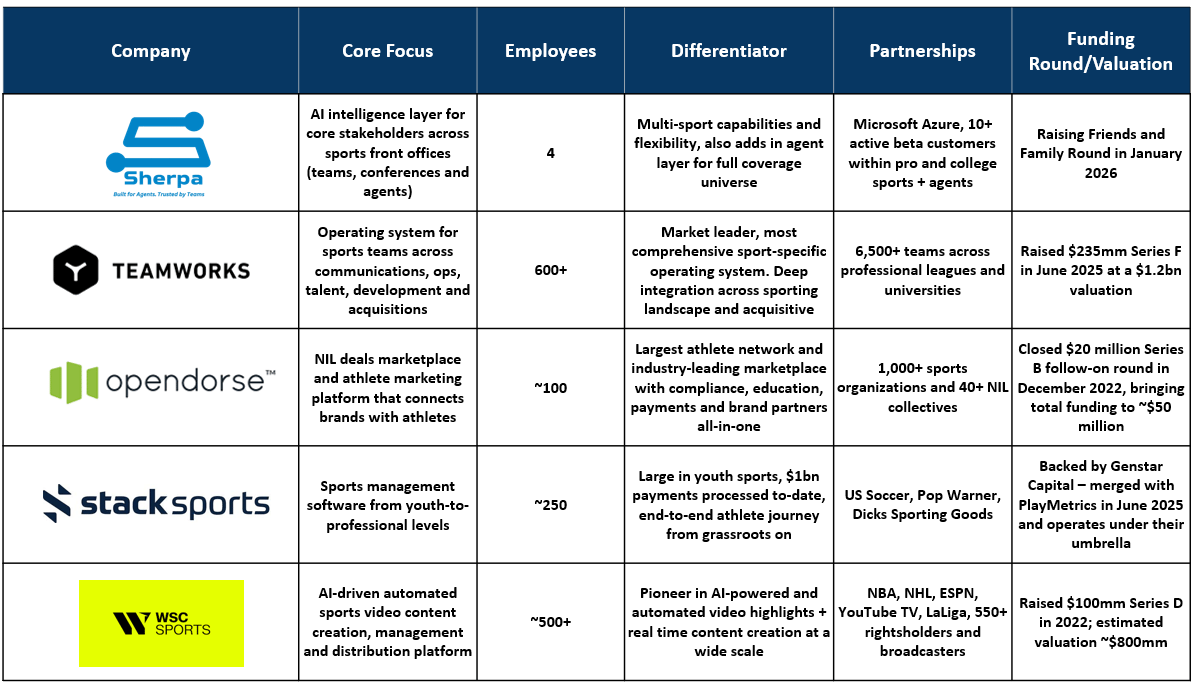

Crowded category with entrenched incumbents in parts of the stack (workflow/operations)

Antiquated industry that even with the legislative changes, still have leaders that are slow to adopt

Long sales cycles and procurement complexity at institutions/conferences

Requires disciplined data strategy + integrations to scale reliably across customers

Comparables:

Sherpa Sports differentiator to Teamworks: Sherpa is the customizable decision engine at scale—teams and leagues configure sport-specific models, portal rules, roster constraints, NIL/contract logic, and reporting across college and pro organizations, not just manage tasks and workflows.

Sherpa Sports differentiator to Opendorse: Sherpa delivers custom NIL intelligence at scale by program, conference, league, or agency—combining performance, exposure, and deal data into configurable fair-market comps, ROI models, sponsorship targeting, and forecasts for college and professional athletes.

Sherpa Sports differentiator to Stack Sports: Sherpa enables recruiting and portal strategy at scale with custom boards, fit models, alert rules, and evaluation criteria tailored by sport, staff role, program philosophy, and level (HS → NCAA → pro)—not one-size-fits-all rankings.

Sherpa Sports differentiator to WSC Sports: Sherpa provides custom video intelligence at scale—programs define tagging logic, scouting cutups, recruiting narratives, and NIL storytelling that flow directly into player evaluation, portal/draft decisions, and athlete valuation at both college and professional levels.

📶The Signal (No Huddle’s Take): Sherpa Sports is a compelling early-stage bet on the decision intelligence layer for sports operations on both the team and agency side. There’s no denying the addressable market is enormous, and Sherpa is emerging at the perfect time, riding tailwinds like AI adoption, NIL and increasingly data-driven sports leaders. We also like how Sherpa is positioning itself as an “intelligence layer”, which should help with adoption and reduce churn once customers are using the product.

The biggest hurdle Sherpa will face is getting in the door; however, we believe in the team’s capacity from both a sales and technical standpoint that they can execute on their GTM strategy. With a few key hires that are well connected in the front office and agency sides, Sherpa could see meaningful uptake. While Teamworks remains the entrenched market leader and default operating system across much of the space, there is room for complimentary players. We also really like the management team and think they are well-positioned to plug into the right partnerships and scale efficiently. At minimum, the SaaS intelligence layer feels like a must-have for all major stakeholders, and it will be fun to watch how the landscape - and Sherpa Sports evolves.

Respond to this email, or reach out to the team at [email protected] for more information.

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.