⚡ The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

After years of handshake agreements, under the table deals and unmarked bags of cash, the NCAA finally allowed student-athletes to profit off their Name, Image and Likeness in the summer of 2021. In the years since, chaos has ensued.

How did we get here? And what’s next?

Well, after years and years of pushback from the NCAA, and superstar players being made an example of (that’s a tribute to you, Reggie Bush), a group of college athletes won a monumental lawsuit against the NCAA in 2021 on the grounds of an antitrust violation. While the NCAA tried to play the boomer card: “College athletes should be students first! A free education is enough!”, the Supreme Court unanimously ruled that the NCAA could not restrict student-athletes from making money off their stardom — changing the landscape of college sports forever.

Now, we see Freshmen commanding (and receiving) 7-figure NIL packages. Even crazier, we see those same athletes leave schools after just a year or two with no ramifications as transfer restrictions have loosened as well:

Before 2018: All student-athletes who transfer must sit-out a year; only eligible to play immediately with a hardship waiver or exemption

April 2021: One-time transfer rule approved without needing to sit-out

July 2021: NIL era underway, allowing athletes to profit from endorsements and sponsorships

2022: NCAA implements official transfer windows on when players are allowed to enter the portal (with no cap)

College sports are now in full-blown free agency mode. After being eliminated from the tournament this past March, Baylor’s basketball team had nobody on it. Transferring has become the new normal path for players to develop and build their brand. These days, it’s rare to see school continuity in a player's ESPN bio.

Why it Matters:

Look no further than this year’s College Football Playoff and March Madness (both Men’s and Women’s). The CFP was dominated by the largest schools, and even with automatic qualifiers by conference, 7 of the 12 teams in the playoff came from the SEC + Big 10.

In college hoops, both the men’s and women’s tournaments saw powerhouse, top-seeded programs in the Final 4, and a record low number of upsets along the way. National Champion Florida and #1 overall seed Auburn were led by the transfer portal -- each with 4+ transfers playing major minutes. Johni Broome, Auburn’s superstar big, transferred from Morehead State in 2022, while Walter Clayton Jr., this year's Final Four Most Outstanding Player, spent 2 years at Iona before heading to Gainesville.

As you can imagine, the explosion of NIL and the transfer portal has forced College Athletic departments to completely retool and restructure their organizations from the top down. Roster management and recruitment as they knew it was no longer. Coaches today need to spend just as much time convincing members of their current team to return as they do pitching high schoolers (and transfers) to join the program.

So far, we have seen a wide range of outcomes as programs embrace different strategies. Rick Pitino outwardly stated that he would not recruit any freshmen to St. Johns, instead opting to strictly build from the transfer portal. We have also seen athletes decommit (or transfer) because of NIL, and programs recruit transfers over coveted freshmen they may be paying large sums to.

The Big Picture:

The transfer portal is now the place to be for college athletes following their season: after the 2023 football season, 25% of FBS scholarship players entered the portal.

Athletes are using their transfer rights to find:

the right situation for them (playing time, development, location)

more compensation

some combination of the two

A prime example of the above was Cam Ward transferring to the University of Miami. Ward was projected as a mid-round draft pick two years ago at Washington State but after leading Miami to a 10-win season and making a huge leap developmentally, Ward went #1 overall to the Tennessee Titans in last month’s NFL draft. Of course, not all transfer stories have a happy ending. Some — like DJ Uiagalelei to Florida State — flopped performance-wise; while others — like UNLV’s Matthew Sluka — left the team midway through a breakout campaign due to broken NIL promises.

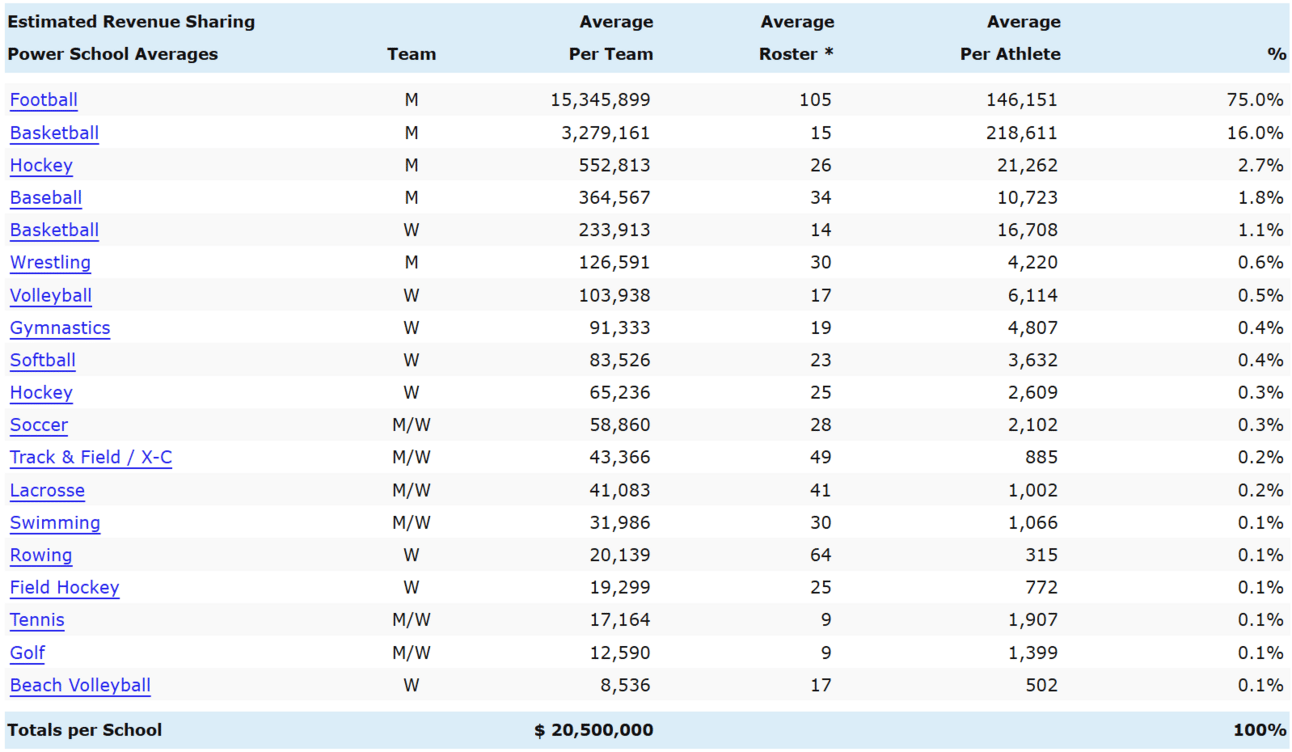

According to Opendorse data from 2021-2024, Football made up 66% of the NIL market, though other sports are seeing a similar rise in both funding opportunities and transfers to find such.

The NCAA’s official transfer portal is showing no signs of slowing:

Source: NCAA Transfer Portal Database

Zoom In:

In the current pay-for-play landscape, NIL collectives work adjacent to institutions to help pool resources from boosters and fans to fund their respective teams. Instead of Tattoogate, Nevin Shapiro running the show down in Coral Gables, or Johnny Football admitting to selling his autographs, student-athletes can now outwardly market themselves and capitalize on their stardom.

Depending on the size of school, their support base and other state logistics, you may see a sport-specific collective – like Ohio State’s football fund (The 1870 Society) or a broader-based collective like Yea Alabama, which backs 10+ Crimson Tide teams (most notably Football and Men’s/Women’s Basketball).

We’ve also seen another method from Duke Basketball, who has strategically leveraged being a private institution to keep all collective funding and negotiations in a black box. The One Vision Futures Fund, started up by financial titans Jeff Fox, Dan Levitan, and Steve Duncker has a mission to compete and never be a distraction.

By the Numbers:

It didn’t take long for NIL to be a billion dollar business, and Opendorse data shows the biggest leaps are yet to come as players, coaches and athletic departments continue adapt to the new status quo.

Source: https://nil-ncaa.com/

The Bottom Line: College sports have changed forever. Though we may see another seismic shift soon depending on the outcome of the current lawsuit around roster limits and revenue sharing, NIL is here to stay. You can expect to see the wealthiest athletic departments continue to dominate the recruiting landscape (plus the top of the standings), and a whole lot more 18-23 year olds walking around campus with some nice change in their pockets…

Where do things go next? Get ready for your local high school star to start signing NIL deals too…

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

The Company: Opendorse

The Business in a tweet: Opendorse helps educate, connect and facilitate NIL endorsement deals for student athletes. Opendorse serves as a one-stop-shop for athletes to ink deals and be paid, all while remaining compliant to current NCAA rules.

The 101:

Industry: Athlete Marketplace, NIL Software

Headquarters: Lincoln, NE

Year Founded: 2012

Founding Team/Current Leadership:

Blake Lawrence - Co-Founder, President

Adi Kunalic - Co-Founder, COO

Employees: 100+

Capital Raising Status:

Closed $20 million Series B follow-on round in December 2022, bringing total funding to ~$50 million

Expected funding uses cases: advancing technology, expanding NIL collective program, and enhancing premium offerings for schools and brands

Backed by Flyover Capital, Serra Ventures, Advantage Capital, Greenway Capital and former NFL player Will Compton

Business Model:

Grant athletes access to brands trying to engage in promotions, shoutouts and appearances by charging a marketplace transaction fee per deal

Subscription Services: Help athletic departments and/or collectives with ongoing compliance management, NIL deal dynamics, and overall market analytics

Provide premium advanced metrics on fair value for players and other NIL budgeting tools

Early Traction:

Used by over 130,000 athletes to help with NIL deals from pitch to contract

Partnered with 100+ Athletic Departments and 40+ Collectives

Deep Dive:

Pros:

Massive market demand for athletes to make money off their NIL, and for brands to find the right opportunity to tap into a new marketing stream

First-mover advantage and proven product-market fit in a growing industry

Easy accessibility and interface to NIL opportunities at the click of a button

Simplifies compliance reporting in coordination with the NCAA and athletic departments

Strong data play — leader in determining fair market value for players, overall roster management, general market mapping of the NIL landscape, etc.

Cons:

Evolving landscape with NCAA and current legal ramifications

Bigger players still go through agency route for more personalized, high-priced sponsorships

Limited customization when working with brands (for now)

Paywalls for exclusive content may restrict access for users on lower-tier plans

No shortage of competition

Comparables:

Sources: Pitchbook, Crunchbase, Tracxn

📶The Signal (No Huddle’s Take): Opendorse is already the industry go-to NIL marketplace, and certainly has first-movers advantage. Opendorse has shown the ability to shift to the market's demands to help stay ahead of the pack (i.e. clubs, premium tools, research reports). With NCAA regulation at another inflection point, we will be watching closely how Opendorse adapts to the next phase of rulings. In addition, we see extremely high upside as a data analytics play, where Opendorse can utilize their proprietary marketplace to help not only deliver insights directly to players and schools/collectives on how to determine fair value, but also opine on where the market is trending as a whole.

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.