⚡ The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

The salary cap is one of the most confusing topics in sports. How is it that the Eagles seem to be able to re-sign nearly their entire roster, while other teams are hamstrung by the cap and forced to let talent walk? (Editor’s Note: looking at you guys down at Jerry’s World) Why do the Dodgers have bottomless pockets and other ballclubs balk at paying a homegrown All-Star?

Salary caps emerged more out of necessity than desire. The first official salary cap arrived in 1984 when the NBA sought to keep the league afloat as player salaries skyrocketed (the cap was $3.6mm!). The concept was revolutionary – tying player compensation directly to overall league revenues. A decade later, the NFL followed suit with a cap of its own, imposing a “hard cap” that teams could not exceed. Many credit the NFL’s competitive balance to these cap restrictions. By 2006, all major US sports had some form of official guardrails on player spending.

Why it Matters:

Salary caps go beyond simple cost control and player management for teams, and they differ significantly from sport to sport. In leagues without a cap, spending discrepancies and unchecked power are commonplace. European Football and the MLB offer clear examples, where the biggest clubs spend heavily to win, while smaller teams are forced to think outside-of-the-box to compete… or be content with last place (much to their fans dismay).

There’s also another angle to roster building: geography. When the shocking Luka Dončić to-the-Lakers trade broke, much was made of how much money Luka would lose in taxes moving from Texas to California. Taxes factor in player recruitment, as states like Florida and Texas emphasize their lack of income tax to attract top free agents. While being a professional GM may seem like a dream job from afar, these dynamics make it one of the toughest out there – and help explain the high turnover rate in the role.

Take a look at the complexities of each league, and the unique approaches taken to collective bargaining and revenue sharing:

The Big Picture:

In the modern salary cap era, on-field success in professional sports is driven by organizational intelligence, coordination, innovation and development – not just financial resources (though that always helps). The most successful franchises have clear priorities and processes for spending and building their rosters.

The correlation between smart roster management and success is undeniable. Teams like the New England Patriots, Tampa Bay Lightning, Los Angeles Dodgers and Kansas City Chiefs have reached dynasty-level, repeated success (Editor’s Note: Eagles fans…your time may be coming) through rigorous revaluation of their team and internal processes. These dynasties focused on roster optimization, advanced scouting, understanding salary cap nuances and the foresight to blend current and future success. And sure, they caught a few breaks here and there too.

Player development is now closely linked to salary cap and opportunity cost as well. Due to the rookie wage scales implemented in all professional leagues, there’s no better value than a player on a rookie contract; which is why teams often spend aggressively when their star players are young and still on affordable deals. Building through the draft remains the most tried and true path to success – a strategy exemplified by the Oklahoma City Thunder, whose core was assembled thanks to Sam Presti's stockpiling of draft capital and shrewd trades.

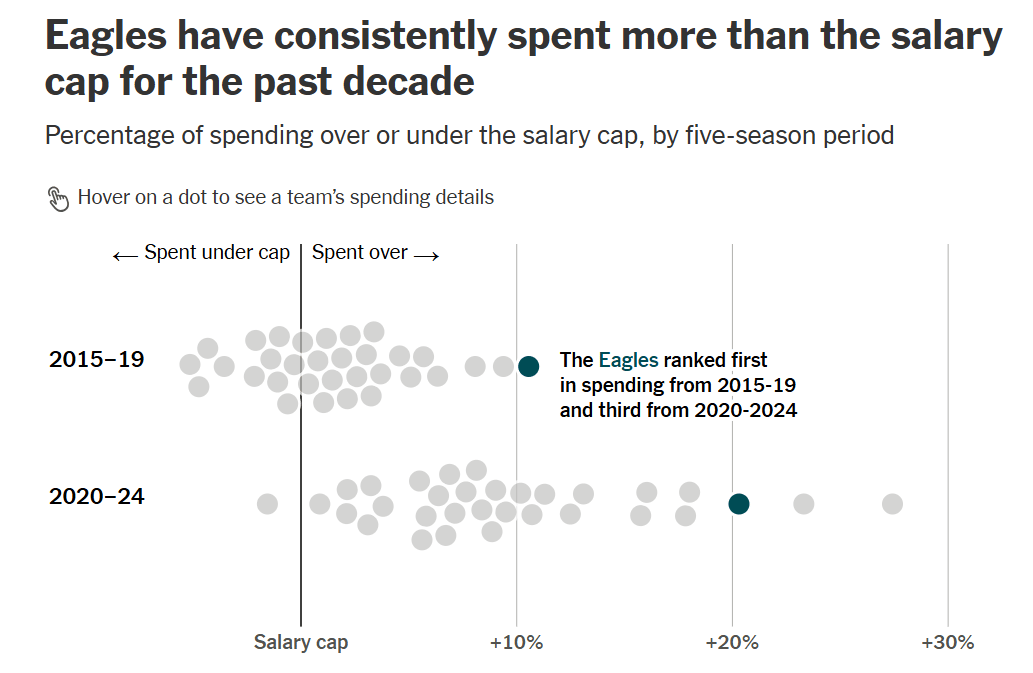

As media rights deals soar and league revenues rise YoY, salary caps continue to follow suit. Although this movement hasn’t always been so linear, the overall trend – as seen in the chart below – shows the steady climb of salary caps. Salary cap growth is a key factor for teams like the Eagles as they plan and shape their rosters.

Sources: Spotrac

Zoom In:

The importance of cap management is no secret across professional leagues. Most organizations now employ full-time staff and utilize specialized tools to manage the salary cap and make decisions on whom to draft, sign, trade or start.

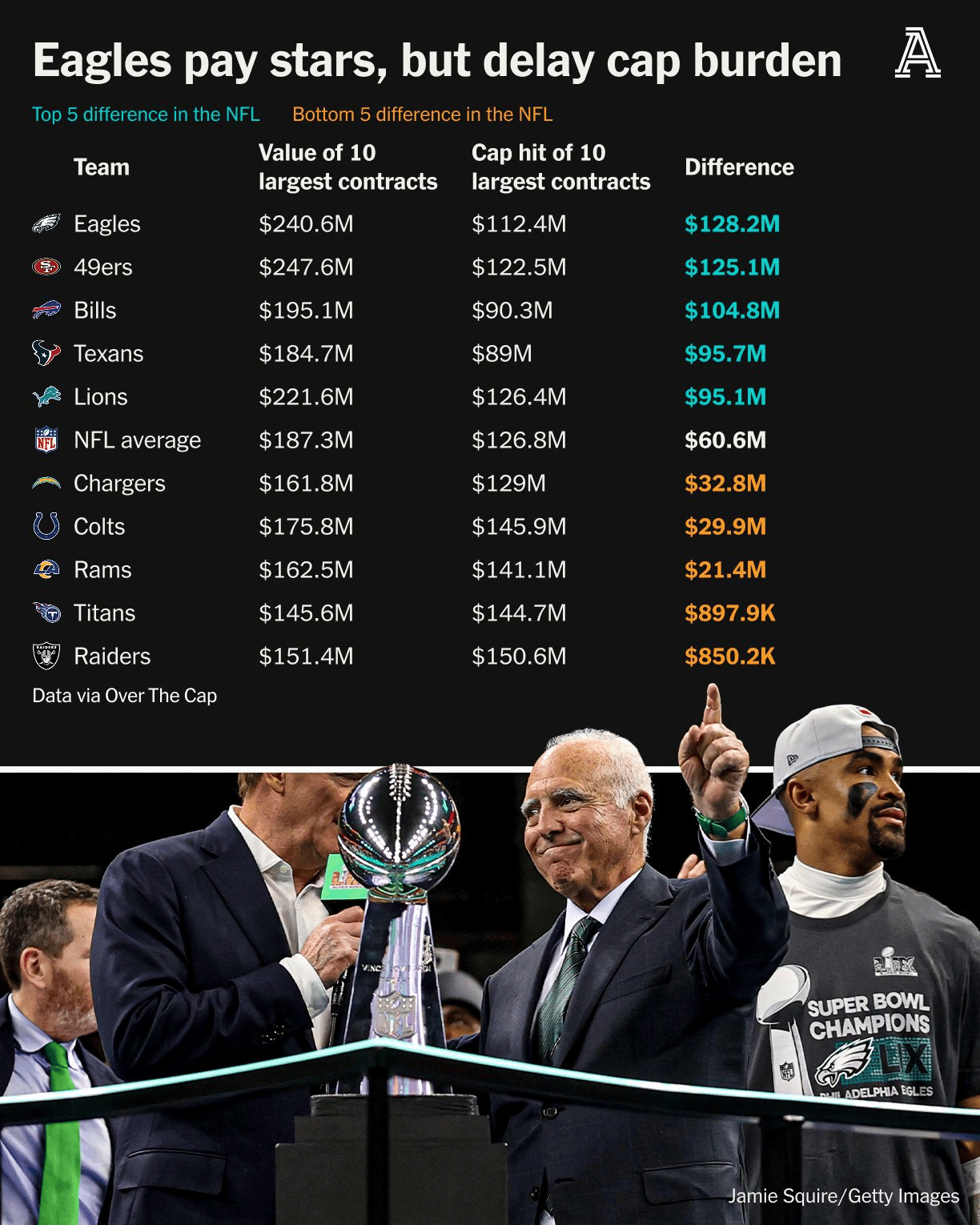

Howie Roseman and the Philadelphia Eagles are the poster child for creative cap management. The Eagles signature move is using ‘void years’ – paying player bonuses upfront but spreading the cap hit over the length of a contract that includes ‘dummy years’, which are added solely to stretch those charges over time. This financial engineering is supported by Eagles Owner Jeffrey Lurie’s deep pockets and commitment to winning… quite different than some owners who treat their teams more like bottom-line assets. While conventional wisdom says this strategy could eventually hurt the Eagles’ roster, the team went all-in on this approach while also benefitting from great drafts over the past few years.

Source: The Athletic

The Eagles rank third in dead cap this year, but are still the betting favorites to win the NFC and return to the Super Bowl (last year, they ranked eighth in dead cap and won it all). Cue your Econ 101 professor explaining the time value of money!

Source: The Athletic

On the flip side, the Celtics are a cautionary tale of how salary cap restraints can quickly derail a budding dynasty. After winning the NBA Championship in 2024, Boston looked poised to be contenders for the next decade, blending young homegrown superstars with savvy trades and strategic free agent signings. Even with the looming second apron luxury tax, Celtics leadership seemed prepared to give this group multiple shots at another title with full belief that the roster was strong enough to withstand the financial penalties and acquisition handcuffs.

That all changed in a flash when Jayson Tatum tore his achilles in the Eastern Conference Semifinals. With Tatum sidelined for a year, new ownership taking over, and the second apron tax on the horizon, the organization decided to reverse course – trading veteran stars Jrue Holiday and Kristaps Porzingis, and letting fan favorite Luke Kornet walk in free agency to shed salary. In just a few weeks, the Celtics roster went from a bona fide championship contender to being projected to finish 8th in the Eastern Conference next year.

By the Numbers:

Each major sport has taken its own approach to the salary cap, but some big changes are likely on the horizon.

The current MLB CBA is set to expire in December 2026, and one of the most contentious issues (and what may lead to a work stoppage) will be the push to institute a salary cap. MLB owners are expected to advocate for a cap, arguing it would level the playing field for smaller-market teams, and bring more structure to the league with the gap in spending between the MLB’s top and bottom teams wider than ever.

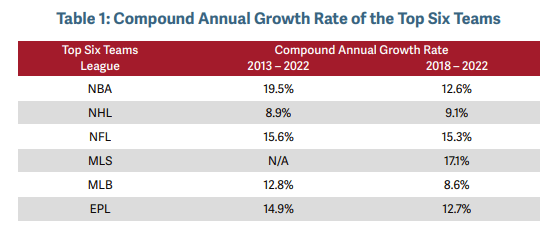

Ultimately, it all comes back to team revenues and franchise valuations, which have grown at a much slower rate in the MLB than in the NFL and NBA.

In other leagues, costs are capped and salaries are directly tied to revenues, but the MLBPA remains staunchly opposed to such a system in baseball. Tensions flared earlier this summer when Bryce Harper publicly cussed out Commissioner Rob Manfred for bringing up the idea of a salary cap during a recent visit to the Phillies clubhouse. Star players like Harper cherish the fact they can let the market determine their worth, as it allows them to sign astronomical contracts. However, not everybody is like Bryce, and it will be interesting to see the role that mid and lower tier players play during these negotiations. These players (the vast majority of the league) feel squeezed by the current set up and may support some form of cap and floor to ensure that teams have to spend and at least try to be competitive.

Editor’s Note: For a deeper dive on this topic, check out Jeff Passan on John Ourand’s The Varsity pod and take a look at the breakdown from our friends over at JohnWallStreet: MLB Collective Bargaining

As for the NFL: the current CBA runs through 2030, but expect owners to push for an 18th regular season game and more international contests (currently capped at 10 per season) as the NFL positions itself for global expansion and dominance.

The most pressing upcoming CBA negotiation is the WNBA, as the current agreement is set to expire on October 31st. The WNBAPA and league owners have been locked in ongoing conflict, and many expect a lockout since neither side wants to budge. The main issues? You guessed it: revenue sharing, the salary cap, and player compensation. This CBA comes at a pivotal moment for the WNBA, as both viewership and investment are surging, while disruptive newcomers like Unrivaled’s 3v3 league are seeing positive tailwinds as well. Unrivaled recently closed a Series B fundraise at a $340mm valuation and announced increased salaries, as well as team expansion plans. Could that be a sign of things to come?

The Bottom Line:

As professional sports grow as an asset class and team valuations become a leading measure of business success, salary cap management and roster building will only become more critical. We strongly believe teams that excel in these areas will have a significant advantage, and will see outsized success on the field / court.

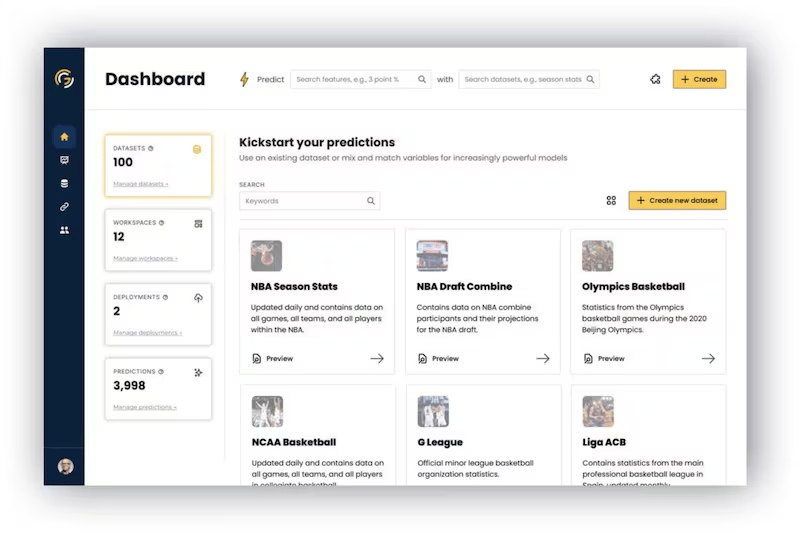

Just as we highlighted the rise of sports analytics in No Huddle Volume 6, new technologies aimed at streamlining and improving roster decisions will shape the future of pro sports.

👀 We even see a budding use case in the new era of college sports: how will college GMs adapt to and navigate revenue sharing in order to build the best team possible?

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

The Company: Gemini Sports

The Business in a tweet: An AI co-pilot for sporting directors, Gemini provides Moneyball-in-a-box with a mobile-first command center for faster, smarter squad decisions.

The 101:

Industry: Sports Technology, Predictive Analytics, AI-Driven Roster Management

Headquarters: Miami, FL

Year Founded: 2022

Founding Team/Current Leadership:

Jake Schuster – CEO & Founder

Cody Swann – Principal Engineer

Employees: 7

Fundraising Status:

Seed round completed in April 2024; $7mm in total funding raised at a $20.5mm valuation

Notable Investors: Will Ventures, Eberg Capital, Social Leverage, Raptor Group

Business Model:

Gemini operates as a B2B SaaS platform with annual licensing and onboarding/setup fees. Its mobile-native application serves sporting organizations – clubs, federations, and leagues – by centralizing scouting, performance, and contract data for real-time decision-making.

Traction:

Gemini is live in production with top-tier and second-division clients globally. Active customers include:

NFL: Indianapolis Colts

Premier League: QPR FC

EFL Championship: Ipswich Town FC

EFL League One: Port Vale FC

Serie B: Como 1907

A-League: Newcastle Jets

Recent renewals and expansion across soccer and football highlight growing adoption and long-term platform value

🔈They said it: “Gemini’s tools help us progress from asking questions to gaining insights much easier and faster, with less manual work,” Colts Game Operations Coordinator Charlie Gelman [now a Football/Game Management Analyst] said in a statement. “We want more of our on-field decisions be data-driven, and this tool help makes that goal attainable.” (SBJ, 2023)

Deep Dive:

Gemini’s platform functions as a mobile AI assistant for the front office. Instead of relying on data scientists or siloed dashboards, sporting directors can tap into a single interface to:

Compare player value projections across leagues

Run “what-if” roster simulations

Filter targets by cost, availability, style, and role

The platform integrates seamlessly with major sports data providers (e.g., SkillCorner, Hudl, StatsBomb) and is built on Snowflake, enabling scalable ingestion and low-latency querying of rich performance datasets. Partners include AWS, Databricks, Infinite Athlete, and more.

Gemini's north star is simple: eliminate bottlenecks and put decision-making back into the hands of sporting leaders.

Pros:

User-first design: Gesture-ready, mobile-native, built for busy execs—not analysts

Partnered early on with lead organizations to mold and shape product

Technical credibility: AWS-native, highly integrative, real-time model execution

No-code layer to existing data infrastructure is key to helping faster adoption

Commercial validation: Renewed contracts and diverse client base across U.S., U.K., EU, and Australia

Experienced, industry seasoned leadership: Schuster brings a slew of sporting experience, having worked across nine sports in seven different countries, giving him a great eyeline into the needs of teams and a global view of the industry

Cons:

Front office help is a saturated, complex and archaic industry:

Tons of competitors all trying to give the extra “edge” to teams

Differentiation across different sports (i.e. Soccer and Football approaches vary widely)

Sports scouting and front office departments are traditionally “old-school”; path to adoption could be slower because of it

Pricing Dynamics – constant price discovery in early days to find the “sweet spot” where teams are willing to pay for a more premium product

Comparables:

📶The Signal (No Huddle’s Take):

We are all aboard the Gemini Sports train. Jake is a leader with a clear vision, strategic plan of attack and background in the sport science world. Gemini has created a product that fills a real hole in a simple, user-friendly way, and has built something flexible enough to match customers needs across several sports. By breaking down the existing barriers in the analytics space, Gemini empowers all front office members to see and understand what is really happening “behind the numbers”.

We are excited to see Gemini enter its next phase of growth and evolve into the “co-pilot” for front offices worldwide. Looking ahead, we think there is real opportunity in college sports, but expect Gemini to focus on expanding its presence among its existing client base in the professional leagues they already serve. Now… if only Gemini could help the Patriots draft a good wide receiver!

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.