⚡ The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

Moneyball. Efficiency. Optimization. Analytics. Just the mention of these words is enough to set Boston Sports Radio off with complaints about how sports have been taken over by “number nerds”. Well, Tony from Fall River is going to have to find something new to complain about, as the analytics train left the station a long time ago and has moved far beyond Billy Beane’s Moneyball era…or Brad Pitt & Jonah Hill’s biopic.

Today, data analytics and cutting-edge sports performance technology are fundamentally reshaping how organizations operate, how athletes prepare and even how fans experience a game. Professional teams are investing billions into performance innovation, and thousands of companies are riding this wave into the sector. Add in all of the hype around artificial intelligence, and it’s clear that this is more than just a trend, it’s a new industry on its own.

While No Huddle has a full roster of topics lined up in this growing space, today’s newsletter focuses on one in particular: the rise of sport-specific analytics and tracking technologies.

Why it Matters: Just like nearly every part of modern life, the surge the surge in sports analytics and performance tracking can be traced back to the democratization of technology. Check your wrist/hand – are you wearing a Whoop, Apple Watch, Oura Ring or FitBit? For some, these devices may be conversation starters, but for many “average joes”, wearables are a gateway into a the world of human performance analytics and (hopefully) a healthier lifestyle. What started as tools for elite athletes and those who could afford them has now become widely accessible to the masses.

The impact of this shift is everywhere. Nearly every major sports club now has its own analytics department, dedicated entirely to gaining a competitive edge through numbers. Instead of sleep stats or muscle strain (though the pros do often have this tracked), these departments main goal is to squeeze out another win, or discover the next hidden gem in the draft or free agency. Straits Research data shows that over 75% of professional sports teams utilize real-time analytics during games to try and gain a tactical advantage.

The shift is happening across the board. On the roster management side, we have seen a drastic shift from chalkboards to dynamic, video-game like platforms. Scouting has transformed from the traditional “eye-test” to a cross between millions of data points and film from every angle. In the medical field, we’re now seeing a wealth of biomarkers and preventative measures worked into training regimens to help ensure that athletes are ready to perform at their best come gameday.

The Big Picture: We all remember the days in youth sports when pitch counts or the number of full-padded practices seemed arbitrarily decided by a group of dads at the local pub. Things are much different nowadays with the influx of modern data platforms like Dick’s Sporting Goods owned GameChanger or safety equipment like Guardian Caps granting us all access to insights to help rethink the development and safety of youth athletes.

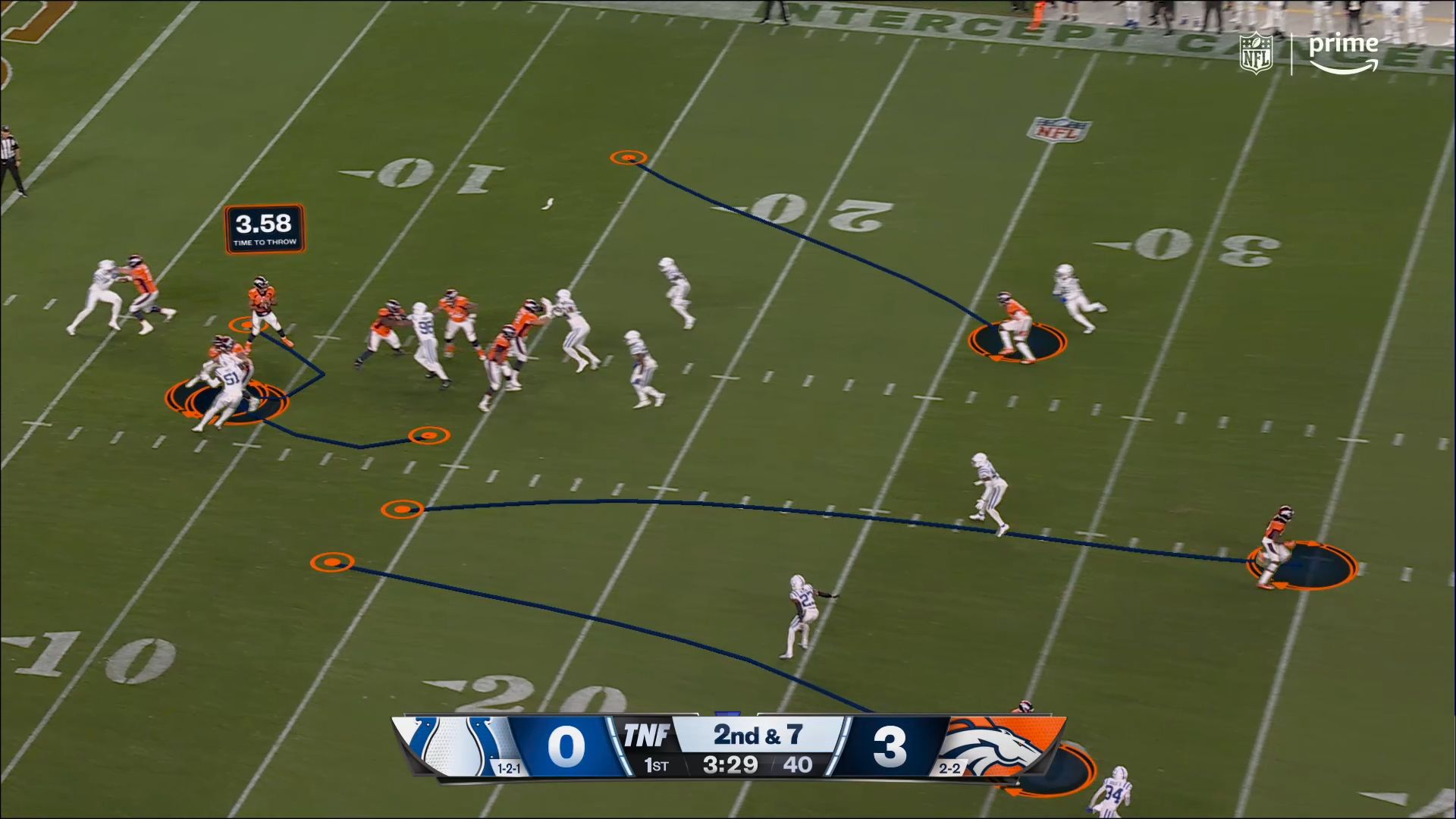

While some professional leagues – most notably the NFL – were very slow to embrace technology (just ask Bill Belichick, who famously bashed sideline tablets back in 2016 and opted to stick to his photo printouts), few - if any - detractors remain. Teams such as the Eagles, Ravens and Browns have publicly committed to being analytics-first, and have integrated them into all aspects of their internal operation to build Super Bowl winning rosters around advanced data. At a league level, the NFL’s partnership with Next Gen Stats (powered by Amazon Web Services), brings advanced real-time tracking and machine learning to fans and front offices. Thursday Night Football (streamed through Amazon Prime Video of course) offers a stats-focused alt-cast, offering fans the chance to see tackle probability odds or how a defense is dropping into coverage in real-time.

ESPN rolled out a similar alternate broadcast for this year’s Western Conference Finals, aptly named “InsightCast”. The programming was led by sports analytics expert Kirk Goldsberry and immersed viewers in a virtual world of player avatars and advanced shot charts to provide deeper insights into how the game / series was unfolding. Goldsberry’s innovative and dynamic ShotBot, which brings shot charts to life, also offers fans and teams a unique visual representation of player performance.

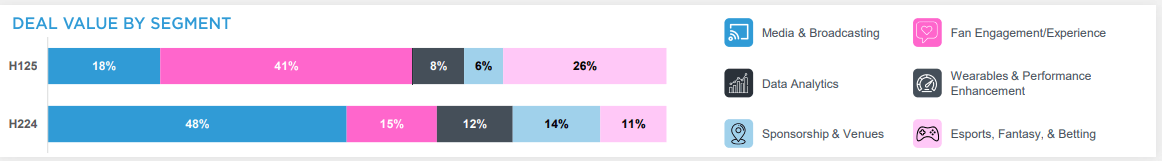

Zoom In: According to Drake Star’s latest report, sports technology transactions reached $52bn in 1H 2025, with early-stage funding deals driving much of the overall investment activity. As we continue to see a collective push to embrace data analytics across the industry, capital and opportunities are flowing in.

Analytics events are starting to gain traction too, with competitions like the NFL Big Data Bowl serving as both an innovation hub for uncovering new patterns and trends, and a pseudo-recruitment platform for NFL teams to hire emerging talent.

While headlines tend to focus on professional and whatever we are calling collegiate sports nowadays, the sports technology x human performance space extends far beyond what we see on TV. AI and machine learning are transforming everything in the space from the speed of highlight production and social media engagements to personalized medical advice. What was once exclusive to the pros: cutting edge products, advanced features and deep analytics, is rapidly making its way into the fast-growing world of Youth Sports world too.

Drake Star’s report also reveals that 41% of all deals in 1H 2025 were in fan experience and engagement, a budding sector that is moving up the priority ladder. Look no further than the state-of-the-art Intuit Dome, designed by Steve Ballmer with the fan experience and home court advantage solely in mind.

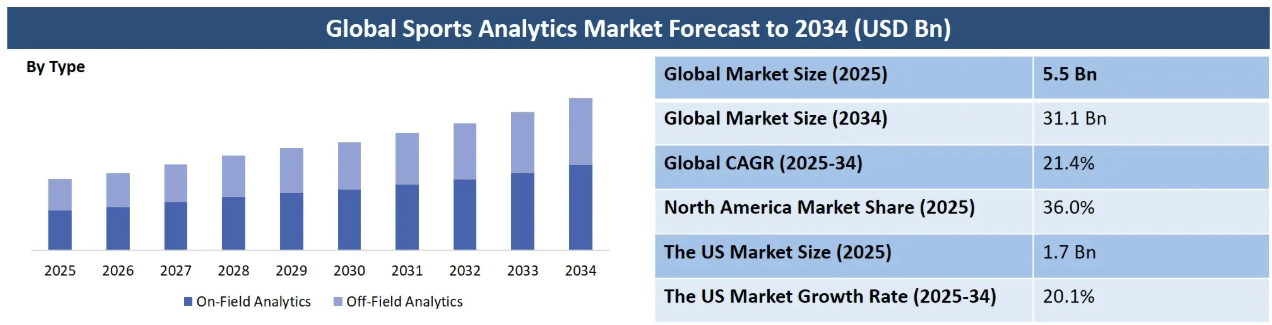

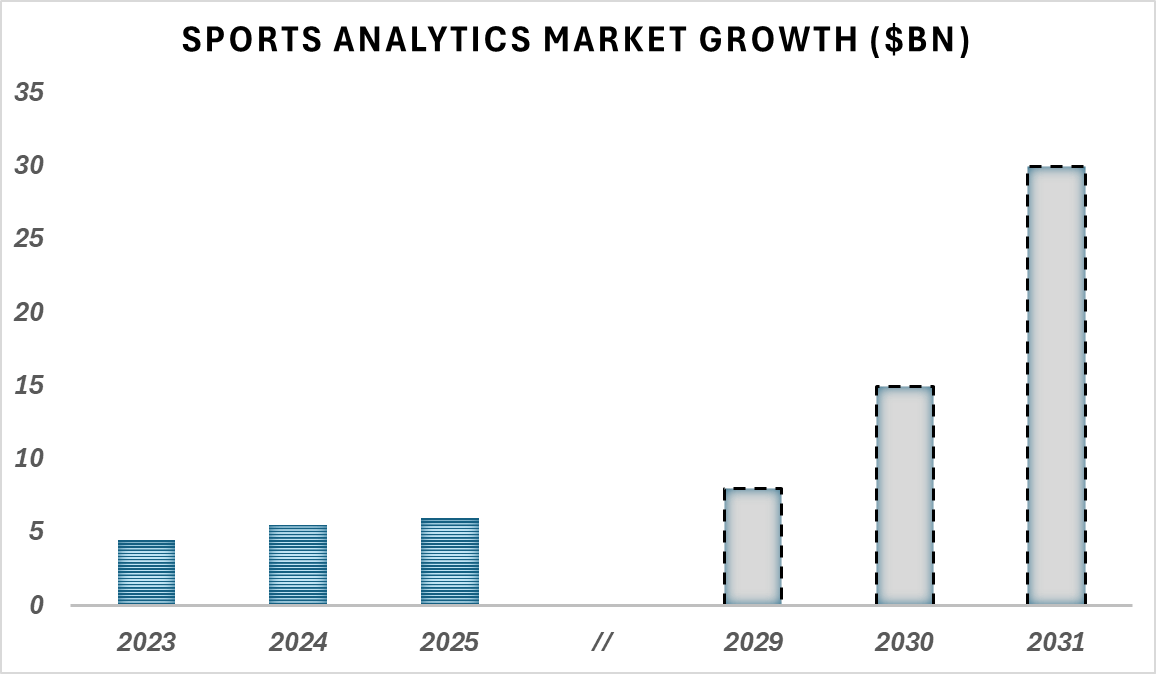

By the Numbers: According to recent research from MarketsandMarkets, the global sports analytics market is projected to grow from ~$5.5bn in 2025 to ~$30bn by 2034.

Source: Precedence Research

Staying on the global stage, both on- and off-field analytics are gaining ground. On the field, we’ve witnessed advancements like broadcasts now featuring Next Gen Stats or Hawk-Eye technology helping revolutionize officiating in sports like tennis to provide unprecedented accuracy and transparency for key calls. Off the field, analytics are growing just as quickly (see chart below). Take dynamic pricing as a prime example: ever wondered why ticket prices fluctuate so much leading up to a game or based on a certain matchups? Teams are leveraging powerful data and insights to power these shifts, often partnering with companies like Qcue —now owned by On Location (a subsidiary of Endeavor)— to deploy agile, real-time pricing models that maximize both attendance and revenue.

The Bottom Line: Don’t get it twisted, we know that what happens between the lines (and part of why we love sports) can’t be captured in a spreadsheet or graph. However, ignoring the transformative revolution across the sporting world would be shortsighted and stubborn. The best path forward is to embrace the change and integrate data-driven insights with the human element.

We are especially bullish on three core pillars of sports analytics: human performance, front office and roster management (including scouting, salary cap strategy and lineup construction) and innovative, outside-of-the box data application — especially surrounding the fan experience at home or at the game. Winning organizations today already coordinate across these areas with precision and depth. And a quick hat tip to Howie Roseman, Andrew Friedman and Sam Presti, whose forward thinking, analytics-backed approaches led to championship rings this past year.

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

The Company: Catapult

The Business in a tweet: Catapult Sports is a global leader in sports performance technology, delivering wearable analytics and digital solutions to nearly 5,000 teams worldwide. From professional teams down to grassroots programs, Catapult’s tools are used to optimize athlete and team performance.

The 101:

Industry: Sports Technology; Analytics & Performance

Headquarters: HQs in Melbourne, Australia and Boston, MA

Year Founded: 2006 - though started in 1999 through a joint venture between the Australian Institute of of Sport and Cooperative Research Centres

Founding Team/Current Leadership:

Shaun Holthouse – Co-Founder, Non-Executive Director

Igor van de Griendt – Co-Founder, Non-Executive Director

Will Lopes – CEO & Managing Director

Bob Cruickshank - CFO

Employees: 400+ across 28 countries

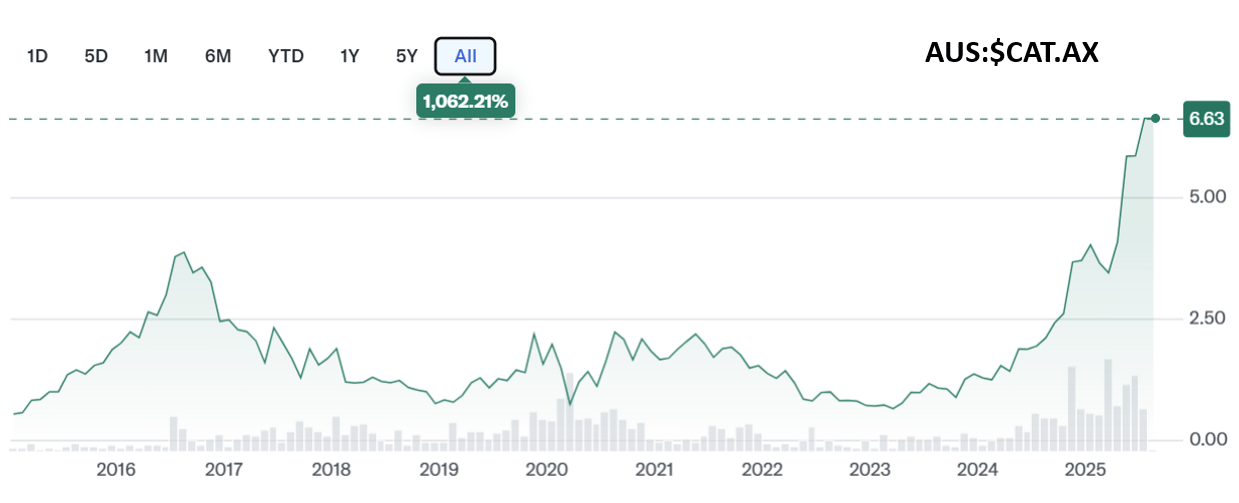

Fundraising Status: IPO’d on the Australian Securities Exchange in December 2014 (ASX: CAT)

Yahoo Finance, as of 8/1/2025 close

Business Model:

SaaS model:

Performance + Health: wearable trackers and analytics

Tactics + Coaching: video analysis and coaching/recruiting tools

Core metrics:

FY ‘25 Revenue: $116.5mm (+19% YoY)

FY ‘25: $8.6mm Free Cash Flow (nearly doubled YoY from $4.6mm to $8.6mm)

ACV (annual contract value): ~$100mm (FY ‘25)

ACV retention: 96+%

Avg. Customer Lifetime Duration: 7.8 years (+11% YoY)

Gross Margin: 81%

Traction:

Nearly 5,000 professional teams worldwide, with standout partnerships including NFL, NBA, MLB, Real Madrid, Chelsea and Bayern Munich

On path to profitability: (net loss improved from -$16.7mm to -$8.8mm YoY)

Recent acquisitions:

Perch ($18mm in 2025) to help build out strength training capabilities

SBG Sports Software ($40mm in 2021) for real-time F1 data capturing and analytics

Drake Maye in the Catapult Vector Pro

Deep Dive:

Pros:

Established category leader and recognizable brand, evidenced by growth and high-profile partnerships

Very strong (and improving) unit economics

Massive TAM spanning global teams and leagues across professional and amateur levels,

Upside to include data into broader wellness initiatives like the Perch acquisition

Diversified sporting portfolio with 40+ sports

AI moat built on years of proprietary data and algorithms

Cons:

Still chasing profitability

Growing competition, more and more companies entering the space as democratization of technology and AI attracts new entrants

Outsized R&D investment required to stay at cutting edge

Comparables:

📶The Signal (No Huddle’s Take): We’re huge believers in Catapult. As a proven brand already embedded in a fast-growing industry, Catapult is exceptionally well positioned to lead the market and accelerate the adoption of performance technology across sports. We remain bullish on the Catapult leadership team, who are steering the company on a path that balances ambitious growth with reaching profitability – demonstrated by rock-solid unit economics and surging free cash flow. We also love the breadth of Catapult’s offerings, as their solutions are tailored for players, coaches and front office personnel to analyze every bit of on-field performance. In our view, companies with versatile, multi-use products are the best places for deep integration and long term success, and Catapult exemplifies all of the above.

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.