Editor's Note

Thank you to our loyal No Huddle subscribers – 5 editions in and we are just getting started. Your ongoing support and feedback so far has been awesome, and is truly what No Huddle is all about.

Want to trade notes? Reply to this note or reach out directly to [email protected].

Now, back to business.

⚡ The Highlight

Breaking down the heaviest hitting topics in the Sports Business world

We’ve all received that text from a family member: a picture of your old stuff asking “do you want this or should I throw it away?”

While the little league jersey and your first hoop headband may be straight to the trash, you may want to think twice before tossing the old trading cards, ticket stubs, autographs, and other memorabilia gathering dust in the attic.

Even if you don’t stumble upon a hidden gem (like this family), the collectibles market is having a moment – morphing from a nostalgic pastime to a sophisticated and lucrative business ecosystem backed by institutional investors.

With recent headlines like Michael Jordan's Signed 1986 Rookie Card selling for $2.5mm, it’s the perfect time to take a deeper look into what is really happening in the collectibles world. (Editors Note: That money would have been better spent on a Lebron Rookie Card)

Source: Joopiter

Why it Matters:

In the world of collecting, headlines, intrigue and serious wealth have long been reserved for big ticket items – think art, artifacts, watches and cars (just ask Ken Griffin, whose art collection has its own Wikipedia section). But a new wave is reshaping the landscape: Gen-Z. Recent data from Bank of America shows that 94% of Gen Z and millennials have interest in collectibles. This shift has helped the market evolve into a legitimate asset class.

Technology has also democratized access, making it easier than ever to discover, authenticate and trade what were once hard-to-locate collectibles. This digital shift has opened the doors to a new group of deep-pocketed investors and innovative companies, all helping fuel unprecedented growth and excitement in the space.

Should you be chasing investment returns or a walk down memory lane, today’s collectibles market has a place for you – and it's never been easier to get started.

The Big Picture:

The collectibles market is experiencing a remarkable surge: Analysis from Market Deciphers Collectibles Market Report in 2024 showed that the sector was valued at nearly $500bn in 2024, with the e-commerce boom playing a pivotal role in expanding access and participation. Forecasts now estimate the market could soar north of $1tn by 2033 as a new generation of collectors takes charge.

This paradigm shift is reshaping the sports and pop culture worlds. In New York, presales for the George Constanza Yankees bobblehead are going for more than the tickets to the game itself.

One of the most significant shifts covered in No Huddle to date has been the transformation of the consumer. Teams, leagues, players and any other sports-related IP are reimagining how to connect with fans, and are now leveraging collectibles as a powerful avenue for engagement. Investments in technology — from authentication to digital marketplaces are rapidly reshaping the landscape, making it easier than ever for fans to feel apart of the community.

Recent data from Cllct shows just how hot this market has become: a record $305mm was spent on trading cards in June, just surpassing the previous high from March. eBay accounted for 85% of these sales, underscoring their ~current~ stronghold in the trading card industry, and also showing how digitized the space has become. Card Ladder’s data for June is just as eye-opening:

6 cards sold for over $500,000 each

68 cards topped $100,000

239 topped $50,000

Trading cards may just be a part of the overall collectibles market, but their continued growth highlights the industry's recent trends as well.

Zoom In: Gen Z’s outsized appetite for viral stardom is one of the most powerful engines behind the collectibles industry’s meteoric rise over the past few years. Nowhere was this more evident than at Fanatics Fan Fest in NYC. After launching in 2024 with ~70,000 attendees, Michael Rubin supercharged the event this year – introducing a broader assortment of sponsors, interactive games, celebrity interviews, meet & greets and brand activations. Attendance jumped past 125,000, and the festival delivered a number of headline-making moments - including Kevin Durant learning live on stage that he was traded to the Rockets.

Fanatics’ influence in sports stretches far beyond just jersey and ticket sales. Substantial investments from professional leagues and players associations have helped Fanatics scale to new heights – and in turn, push the collectibles market to the mainstream. High profile events like Tom Brady’s card deal and the Fanatics Museum of Greatness offer just a glimpse into how this industry is being reshaped and marketed.

Fanatics isn’t the only company making waves. The collectibles landscape is attracting a new generation of innovators. One of the most exciting developments has been the rise of fractional ownership – a modern, democratized investment model reminiscent of platforms like Robinhood. This approach helps even the playing field, opening the door for everyday collectors to own shares of high-value assets that have historically been far out of reach.

Platforms such as Rally Rd let users buy & sell equity in everything from a game-worn Lebron James NBA Finals jersey to rare artifacts like the “BCQ 24” Stegosaurus Skeleton”. The breadth and depth of offerings through the company are amazing, and an easy place to get lost scrolling.

Recognizing these industry shifts, companies have consolidated and/or forged strategic partnerships – a clear sign of an industry that is rapidly maturing.

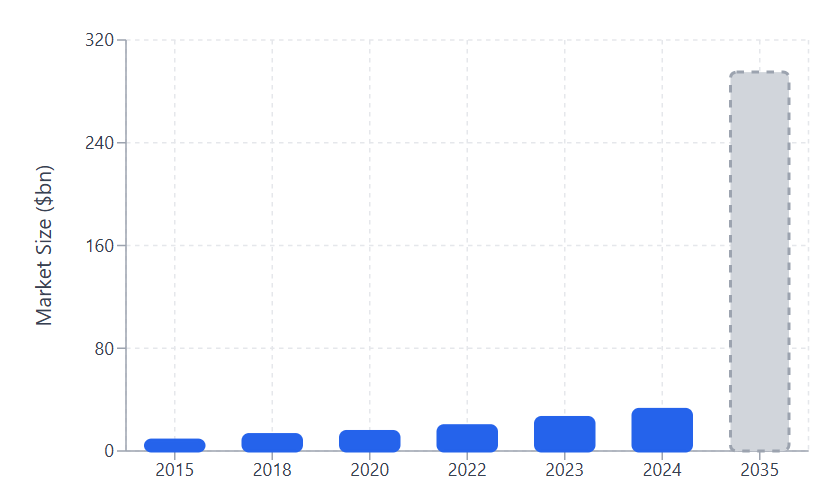

By the Numbers: The sports collectibles market was valued at ~$30bn+ in 2024, and is projected to jump 3-4x in the next decade – potentially reaching $270bn+ by 2035.

The collectibles industry is also more diverse than ever, attracting investors and enthusiasts across a wide range of categories from trading cards to sneakers to pop culture artifacts. Recent innovations like NFTs and Blockchain have driven the rapid growth in the digital collectibles world, though more traditional segments like trading cards and sneakers still command the largest share of the market (for now).

The Bottom Line: Collectibles have the staying power and stickiness that investors dream about. As the industry evolves from an old-school trading market to a hotbed of innovation and growth, fans will continue to find new ways to interact, collect and invest.

We think the next hotbed in the collectibles space will be college sports. Buzz (and money) continues to pour in, and companies like NIL FANBOX offer unique ways for college athletes and athletic departments to connect with and monetize their devout fanbases.

The question now is shifting - how can all of those involved in the college athletics windfall find ways to benefit? We have conviction that the answer may lie in innovative partnerships and platforms that connect all stakeholders in one place.

📺 The Watch List

A mini investment memo on the most innovative sports tech companies

The Company: Cllct

The Business in a tweet: Cllct is a leading media and advisory platform in the sports, entertainment and pop-culture collectibles world. Cllct combines in-depth reporting, brand partnerships and immersive fan experiences to create a new medium for collectors to stay informed and connected.

The 101:

Industry: Collectibles and Media

Headquarters: New York, NY

Year Founded: 2024

Founding Team/Current Leadership:

Darren Rovell – Founder

Steven Ziff – CEO

Employees: 12

Fundraising Status: Raised $4mm Seed round in 2024

Cap table includes: Phoenix Capital Ventures, Tallwoods Capital, Ted Leonsis, Bolt Ventures, Amity Supply, and others

Business Model:

Consulting fees from entertainment conglomerates like Monumental Sports

Typically include strategy such as fan engagement programs and asset preservation

Bespoke Sponsorship Activation through experiences (i.e. Fanatics Fest, or a display outside of the NYSE)

Ad-revenue sharing deal with Yahoo

Partnership includes co-created collectibles content hub

Direct ad sales

Sell ad placement direct on website and on ‘Cllct Call’ newsletter

Traction:

Widely recognized as early leader in the collectibles media space

Continue to expand on the partnership front with sports & entertainment brands:

Most recently with sports franchises and entertainment conglomerates (ex. Monumental Sports)

Deal with Yahoo Sports to help build out a comprehensive collectibles content platform

Social media following: ~10k followers on X, ~208k monthly website visits (SimilarWeb)

Deep Dive:

Pros:

Early in massive collectibles market ($500+bn in 2024) and projected to exceed $1tn by 2033 (Market Decipher)

Can leverage tailwinds of ‘alternatives’ investment surge, which is becoming more commonplace as a recommendation to diversify investments

Gen Z driven demand: ahead of the curve on what is most interesting to the upcoming generation of fans/collectors. Huge LTV value proposition: 77% of Cllct website traffic is males 25-44

Operate as a media/advisory hub, helping avoid market risk others take on (i.e. trading platform or authenticity concerns as technology develops)

Cons:

The collectibles market (like nearly any asset class) can be very volatile, sensitive to consumer sentiment and broader economic conditions

Media incumbents with built-in platforms starting to realize opportunity and jump into the space:

Cllct has done a good job getting ahead of this trend (i.e. Yahoo partnership), but other large media brands like Sports Illustrated, ESPN and Bleacher Report are adding collectibles coverage

Notoriously difficult sector for an exit: while it has happened (see The Athletic and Axios), venture-backed media is a very tough space to mature enough to be worthy of a significant exit

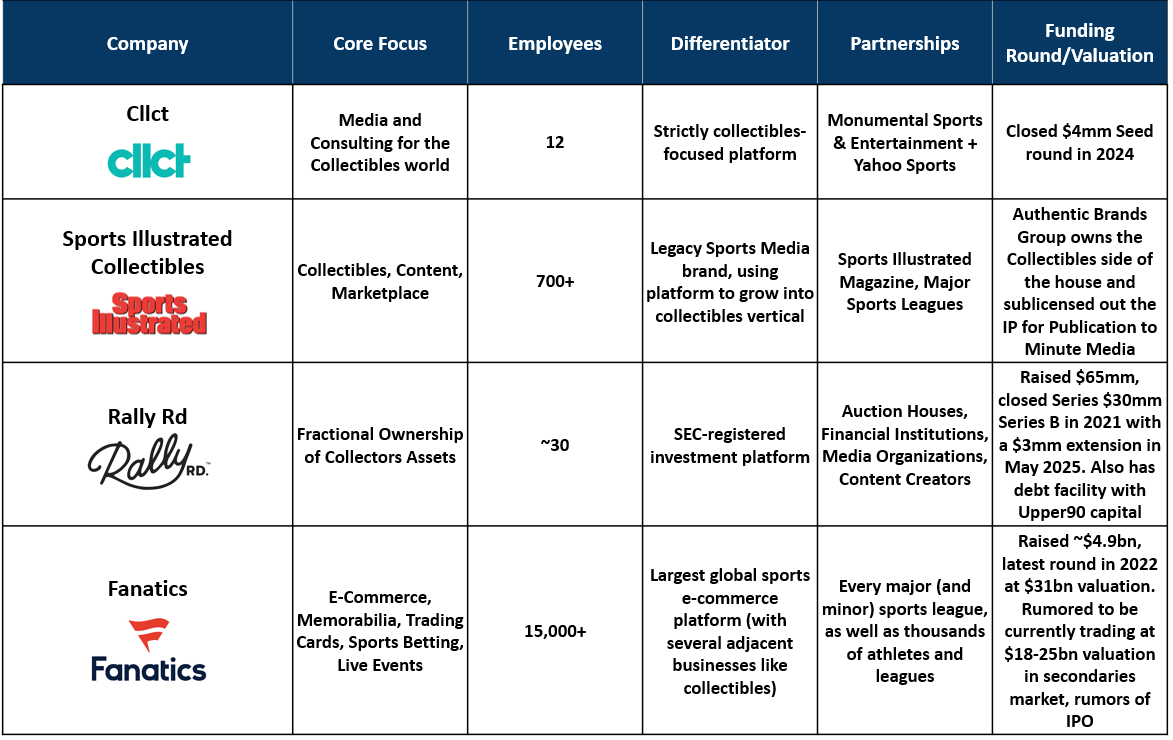

Comparables:

📶The Signal (No Huddle’s Take):

With its diverse mix of revenue streams and advisory services, Cllct is uniquely positioned to lead the charge in the booming collectibles industry. As with any media company, sustained success will depend on the strength of its content, distribution reach and loyalty of its audience. Backed by Darren Rovell’s business acumen and substantial social following, the company has already found its product-market fit, and seems to be in good hands to get over the critical ‘0 to 1’ hurdle.

We recognize the niche market Cllct is starting to gain a stronghold on and also remain optimistic about the growth potential of the collectibles marketplace itself. We think the marketplace segment and selling D2C (or C2C), offers more upside driven by direct transactions, marketplace data, network effects and an expanding customer base. With that being said, Cllct stands out as an attractive strategic partner or acquisition target for a larger conglomerate or media organization looking to grow their presence in the collectibles industry.

No Huddle is for informational purposes only and is not financial or business advice. The content in this newsletter does not represent the opinions of any other person, business, entity, or sponsor.